Finding the Best Way to Repay Your Debt

BrightPlan Team

There are usually two ways to get to where you’re going, right? One may be the direct route on the highway with more cars and more traffic. The scenic route has fewer cars and may be more pleasant, but takes a bit longer.

On the journey to becoming debt free, there are two well-worn roads that have helped millions of people pay off their debt and free their income for other goals. These two popular methods are called the Debt Snowball and the Debt Avalanche.

But which one is the highway, and which one is the scenic route? More importantly, can one help you celebrate freedom sooner?

You Need a Debt Payoff Plan

Before diving into the details, let’s be clear. It’s smart to develop a plan to pay off your debt and to commit to that plan. Both methods have worked and will keep working because they provide a crystal-clear path to:

- Organize your debt

- Direct additional monthly payments

- Track progress to freedom

- Save you money on interest

Either plan can make you debt-free faster because they assume that you’re making additional monthly payments beyond the minimums on your loans. Finally, both plans assume that when you pay off one loan, you don’t take your foot off the gas. The payments that were being made toward that loan get applied to the rest of your debt, building momentum to pay the next loan off even faster.

Depending on which plan you choose, you’ll be directing extra payments to the loan with the smallest balance, or the loan with the highest interest rate. Let's start with the better method, the Debt Avalanche.

The Better Method - The Debt Avalanche

Identify the highest interest rate debt and pay it off first; then move on to the next highest interest rate (always paying the minimum payment on your other debts).

By targeting the debt with the highest interest rate, the Debt Avalanche pays off your debt earlier and saves you the most money on interest expense. Mathematically, the Avalanche is the best way to reduce your debt.

Here are the steps to the Debt Avalanche:

- List your debts from highest interest rate to lowest interest rate.

- Pay the minimums on all of your loans.

- Apply all additional payments to the highest interest debt until it is paid off.

- Work your way down the list, always paying off the most expensive debt.

The key is to stay motivated by tracking your progress. Celebrating the progress made on your expensive debts (paying 10% of a debt off, seeing your debt-to-income ratio decrease, etc.) will help you stick with the Debt Avalanche plan and give you the psychological ‘wins.’

Speaking of the psychology of debt reduction, those quick wins and measurable progress are what the Debt Snowball is all about.

The Other Method - The Debt Snowball

Identify the smallest dollar amount debt and pay it off first; then move on to the next smallest dollar amount (always paying the minimum payment on your other outstanding debts).

The Debt Snowball is all about momentum. Think about a snowball rolling down a mountain, starting small but quickly gaining speed and size on the way down.

Popularized by Dave Ramsey, here are the steps to the debt snowball method:

- List out your debts from smallest balance to largest.

- Pay the minimums on all of your loans.

- Apply all additional payments to the smallest loan until it is paid off.

- Work your way down the list, always paying off the smallest loan.

The big benefit of the Snowball Method is psychological. Paying off small debts first gives you ‘quick wins’ early on, making it easier to stick with the plan.

The downside of this approach is that it doesn’t pay attention to the interest rates on your loans. What if you have multiple small student loans with a 5% interest rate carry a large balance on a credit card with a 17%+ interest rate?

Is paying off the last $2,500 on your student loan really better for you? It may be a quick win, but it is bad math. To minimize the interest you pay on your debt over time, you – at least – need to pay attention to your interest rate. While psychologically it is easier to adopt the Snowball Method, the better tactic is Avalanche.

Some Interest-ing Math on the Methods

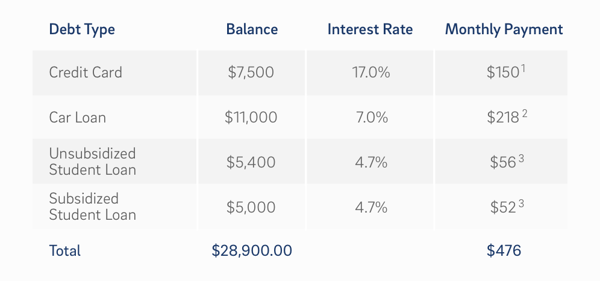

Want proof? We put both methods to the test with a hypothetical example. Meet Grace. She’s in her early 30s and is planning to pay off a total of $28,900 made up of her last couple of student loans, a credit card, and a car loan.

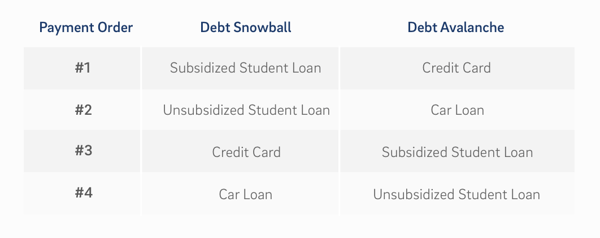

Grace would pay off her loans in this order based on the Snowball and Avalanche Methods.

Now for the grand finale. Does it work? The next table shows the results if Grace applies each method. It compares what would happen if she took the easy route by paying the minimums on each loan, or applied an additional $150 per month using the Debt Snowball or Debt Avalanche Method.

As you can see, the Debt Snowball is an excellent strategy. Grace will pay off your loans more than twice as fast, 5 years and 3 months earlier than if she just pays the minimums. While it may be tough to come up with those additional monthly payments, they will save her nearly $3,000 in interest expense. Just think about the opportunities that come once all your debt is paid off.

However, the Snowball is not as great as the Avalanche, which would save Grace $5,123 in interest expense and gets her debt free an additional 4 months faster - just by redirecting those additional payments to her highest interest loans!

Whether you take the pleasant, psychologically easier scenic route to debt repayment, or the more direct highway to financial freedom, sticking to the plan is key.

Ready to Pay Off Your Debt?

Oftentimes, the biggest barrier to reaching other financial goals is a high percentage of your income going to debt repayment. We built the Debt Reduction Planner to help you organize your debt and figure out a manageable plan to pay it off.

When you link your loans to BrightPlan we can show you exactly when you’ll be debt free, how much interest an extra monthly commitment can save you, and help you track your progress to freedom.

And as you can probably guess, the debt reduction planner helps you pay off your loans with the Debt Avalanche. Ready to see how soon you could be debt free? Sign in.

Notes on minimum payments:

- Credit card minimum calculated as 2% of balance. Minimums vary, but many providers including most credit unions simplify the calculation by making the minimum 2% of the balance.

- Source: Bankrate.com Auto Loan Calculator, assumes a 60 month term.