What’s New in BrightPlan - Smart Budget Got Smarter

Jeff Clark, CFP®

Last Fall we launched Smart Budget, an automated budgeting solution designed to help you gain control of your money. In our latest BrightPlan release we’re excited to reveal a set of powerful Smart Budget enhancements to make your budget even better.

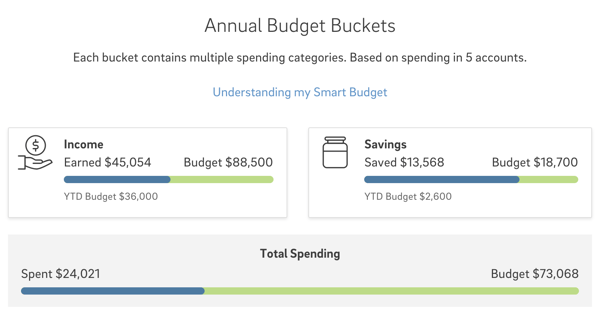

Now you can see your Income and Savings in brand new Budget Buckets, gain a summary view of all of your spending for the month, check the Budget Trends tab for year-to-date budget numbers, and create Rules for easier budget management. Let’s dig in.

Income and Savings Budget Buckets

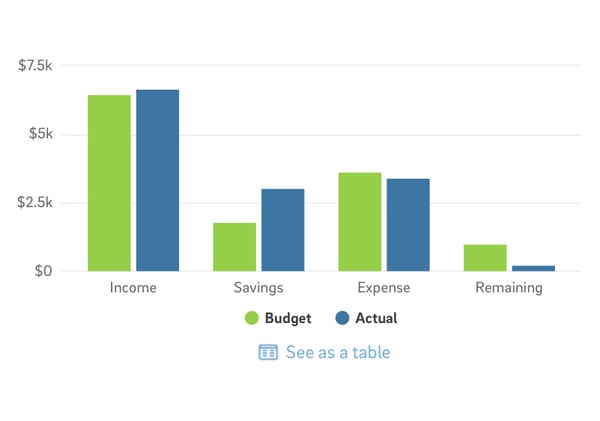

Originally Smart Budget included three high level budget categories. Your Income, Expense, and Remaining. This month we’ve added the fundamental item of Savings to the mix.Visualizing savings is critical to seeing how much of your paycheck is going towards long-term goals. Seeing saving and spending side by side helps us understand the tradeoff we make with every dollar. Do I spend it today or save it for later? To simplify the chart, we’ve also added a table view.

Seeing saving and spending side by side helps us understand the tradeoff we make with every dollar. Do I spend it today or save it for later? To simplify the chart, we’ve also added a table view. Your Savings budget is calculated from your planned Savings to goals in BrightPlan. As you adjust your goals, your budget automatically updates. Your actual savings is calculated based on your transactions in linked bank accounts.

Your Savings budget is calculated from your planned Savings to goals in BrightPlan. As you adjust your goals, your budget automatically updates. Your actual savings is calculated based on your transactions in linked bank accounts.

Simplifying monthly spending

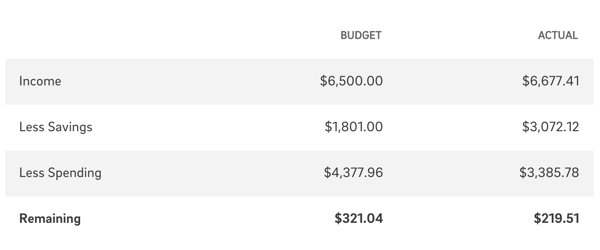

Simplicity is a pillar of Smart Budget design. We want everyone to feel comfortable budgeting because only a rare few will stick with a complicated budget. That’s why we bundled spending categories into the 12 Budget Buckets, and why in this release we’ve introduced Total Spending as one condensed view of your spending for the month. Just like your Budget Buckets, your Total Spending fills up as the month progresses and you move towards spending your entire budget. Now you can check in throughout the month to see how much of your budget is spent, make changes if necessary, or give yourself a pat on the back when everything looks great.

Just like your Budget Buckets, your Total Spending fills up as the month progresses and you move towards spending your entire budget. Now you can check in throughout the month to see how much of your budget is spent, make changes if necessary, or give yourself a pat on the back when everything looks great.

See the big picture with Budget Trends

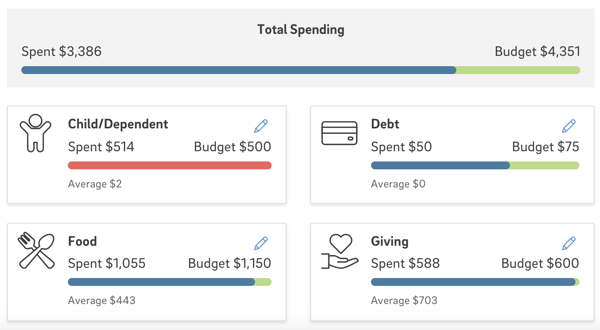

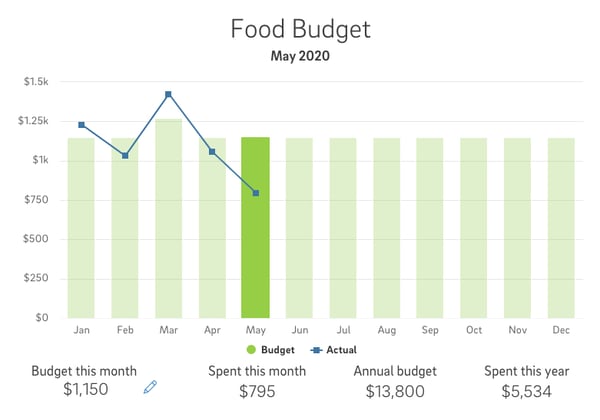

Smart Budget began with great insights into your Monthly Budget. The brand new Budget Trends tab pans out to a big picture of your money with a full year view of your Smart Budget. This page answers big questions like:

- How much has my take-home pay been so far this year?

- Am I spending too much this year on food or do I have wiggle room for more sushi?

- Did I spend more or less this month than last month?

The chart at the top of the page summarizes budget trends for one year. You can toggle between years and turn off items on the chart to look at a single trend like your Actual Income. Below the chart you’ll find Annual Budget Buckets. Just like monthly budget buckets, these buckets fill up over time. The data in Budget Trends is fascinating. My jaw dropped when I saw my annual numbers laid out for certain categories, and I hope you find it equally insightful.

Below the chart you’ll find Annual Budget Buckets. Just like monthly budget buckets, these buckets fill up over time. The data in Budget Trends is fascinating. My jaw dropped when I saw my annual numbers laid out for certain categories, and I hope you find it equally insightful. Your Annual Budget is the total of your monthly budgets for the year. For the current year, you can see your Year-to-Date numbers, which helps you monitor if you're on pace to hit your budgeted amount. As always you can select a bucket to see the trend for that Budget Bucket for individual months.

Your Annual Budget is the total of your monthly budgets for the year. For the current year, you can see your Year-to-Date numbers, which helps you monitor if you're on pace to hit your budgeted amount. As always you can select a bucket to see the trend for that Budget Bucket for individual months. It looks like I don’t have much money to spare for sushi.

It looks like I don’t have much money to spare for sushi.

Save time with Transaction Rules

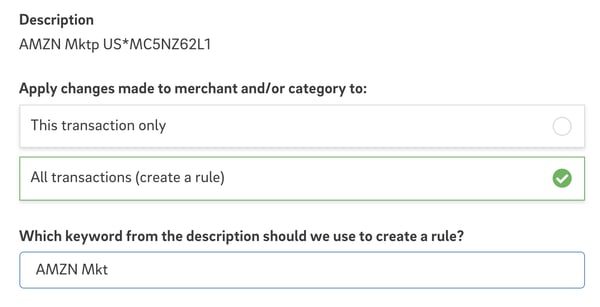

Your Budget is only as strong as the data behind it. Auto-categorization of transactions in BrightPlan is powerful, but not perfect. Now we’ve made it easier to bulk update your transactions with enhanced transaction rules.

Here’s how it works. When you edit the Merchant or Category of a transaction, you’ll see the option to update all similar transactions by creating a Rule.

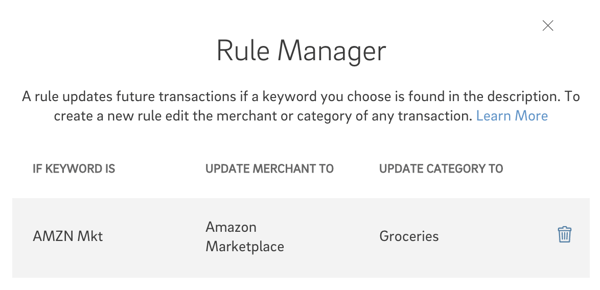

Let's say a transaction from Amazon Marketplace came in categorized as “Electronics/General Merchandise” but I know it was in fact “Groceries.” When I change the transaction category, I’m presented the option to create a rule. The Rule will apply to all transactions, and is determined based on a keyword from the Description. Typically a subset of the Description will cover all similar transactions. In this case I chose “AMZN Mkt” to catch all of the future transactions.

The Rule will apply to all transactions, and is determined based on a keyword from the Description. Typically a subset of the Description will cover all similar transactions. In this case I chose “AMZN Mkt” to catch all of the future transactions.

When I save the rule, all previous transactions will be updated by the rule and any future transactions will be filtered through this and other rules. Over time you’ll build multiple rules and your Smart Budget will get even smarter. The new Rules Manager allows you to review and delete your rules any time.

It’s never been easier to master your money

A good budget is the engine of a solid financial plan. It propels you towards your big financial goals by directing you to set and hit smaller saving and spending targets every month. Our engineers have been tinkering with Smart Budget for months and we are so excited to finally put it into the hands of our clients.

Each month as you review your budget, make adjustments, and see progress, you get a little better. We’ve taken out many of the pain points in Smart Budget to make it an enjoyable skill to master. Ready to master your money? Select the Budget tab in BrightPlan to get started.