The Most Common 401(k) Mistakes People Make - And How to Fix Them

Matt Baisden, CFA, AIF®

As a Retirement Plan Advisor for Plancorp, I spend a lot of my days talking to retirement plan participants about their 401(k) plans. In conversations and presentations, I get to educate participants to help them get the most of their retirement savings.

I stress the importance of getting the big decisions right (or at least taking time to address them). No plan can be perfect, but if you can get the big things right, you will be set up for a much more successful retirement. Here are a few of the most common 401(k) mistakes I see, as well as how to fix them.

1. Forgetting About Old Retirement Accounts

I am a fan of the KISS method of managing financial accounts: Keep It Simple (Stupid). Because they are portable, 401(k)s make this easy. You can take your money with you when you leave an employer and consolidate it all into one account.

Often though, people leave an employer and forget about their accounts or believe they will handle them later. This can result in unnecessary complications, poor investment planning and high costs. Do yourself a favor and take the time to move your 401(k) when you change jobs. The paperwork usually takes fewer than 20 minutes to complete and 2 weeks to process.

Roll over old 401(k)s into a Rollover Individual Retirement Account (IRA), which you can do at BrightPlan. This allows you to have most of your money in one place, keep costs low, and be properly invested for your specific retirement plan.

Once you’ve consolidated, you can KISS your old plan goodbye forever.

2. Ignoring the Elephant in the Room: Your Savings Rate

Your primary focus should be your savings rate. Think about it this way: even if you are a genius investor, if I save $10,000 a year and you save $5,000 a year, I will probably retire earlier than you.

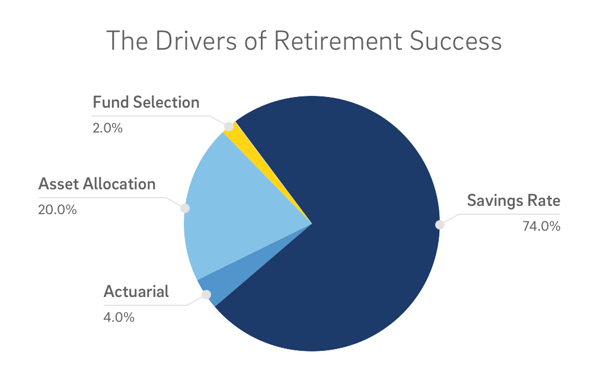

In fact, your savings rate is approximately 5 times more important than your asset allocation (how much you invest in stocks and bonds) and about 45 times more important than what specific mutual funds you choose.¹ If you can only get one thing right, this should be it.

As a starting point, save at least enough to get your full employer match or 5%. Every year after that, raise your savings rate by 1%. Set an annual reminder in your phone on January 5th to do this. You are likely in work mode at that point, and you may have gotten a raise that kicks in next paycheck. Set the reminder now.

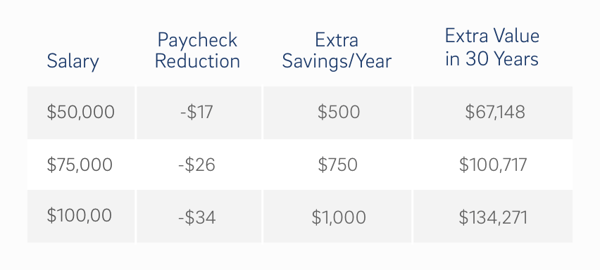

Often people worry that raising their savings rate will mean they can’t pay their monthly bills. If that’s you, start small. The table below shows how a 1% increase in savings will barely affect your take home pay, but it could mean tens or hundreds of thousands of dollars more for you in retirement.

3. Making Bad Investment Choices

Choosing how to invest your money is confusing. Financial jargon is too common in retirement plans. Often people choose to invest in what’s done best recently – like tech stocks in 2000 and real estate in 2007. We know how that turned out.

Choosing specific funds is often a bad decision. Luckily most employers have made large strides in the last several years to simplify, which is again my advice for you.

Hopefully your plan has what are called Target Date Funds or Model Portfolios. Target Date Funds are built for people to stay properly diversified for a specific Target Retirement Date.

The fund manager does this by automatically adjusting your portfolio to take on less risk as you get closer to retirement. They are easy to spot because they typically have a year like 2040 or 2045 in their name. If these are available, use the one that is closest to your desired retirement year.

If Target Date Funds are not available in your fund lineup, hopefully model portfolios are. Model portfolios often contain words like Conservative, Moderate or Aggressive. Again, these funds are built to do the work of diversification for you. Consider investing in one based on your risk tolerance.

Unlike Target Date Funds, Model Portfolios will not adjust to become less risky over time, so you may have to adjust your model as you close in on retirement.

4. Overlooking Investment Fees

A final mistake I see is people overlooking investment fees and just selecting the funds with the best returns in recent years. Outperforming fund managers tend to be flashes in the pan, unable to sustain their success. On the other hand, lower fees are the most reliable predictor of better performance.

If there’s one number you should look at when buying funds, look for low fees – less than 0.50% annually. Focus on keeping your fees low because you cannot control returns, but you can control your expenses.

If low cost funds are not available in your retirement plan, ask to see if your company offers other options. You could be a hero in your company, with every employee benefitting from your advocacy for better investment options.

Take the Time to Fix Your 401(k)

People regularly ask me how they can get on track for a better retirement, and avoiding these mistakes will put you far ahead of the pack. Roll over old 401(k) accounts. Focus on your savings rate. And simplify your investment strategy by choosing low-cost target date funds or model portfolios that do the work for you.

Spending a couple minutes reviewing your retirement plan can set you up for a better retirement. Get these big things right, and you won’t have to sweat the small stuff.