The Smart Way to Fund Your Future

Jeff Buckner, CFP®, AIF®, Co-Chief Investment Officer

This post is part of a series on the BrightPlan investment philosophy, our game plan to help you reach your goals. To see the rest of the series check out:

Part 1 - Introduction to Evidence Based Investing

Part 2 - Don't Try to Outguess the Market

Part 3 - Let the Market Work For You

So you’re convinced that markets price securities efficiently. You know active management is an expensive investment strategy with an inferior performance record. You have goals, they cost money, and you want to let markets work for you to build wealth. A massive question remains, “How should I construct my portfolio?” This post outlines our answer to that question.

Imagine trying to build the perfect mix of investments for your life plan. Fourteen years from now you hope to send your child to college, but in six years you want to put a downpayment on a vacation home. In twenty-five years you plan to retire, but the idea of starting a company has always inspired you. Each goal has a different timeline and requires a unique strategy.

How can you flex your finances to save for these various goals? What growth will you need and how much risk can you take while investing toward each? Could your plan pivot along the way with an unexpected expense, windfall, or move in the markets? The math required to build specialized strategies for each of these plans is daunting. Unfortunately, most people don’t have a plan, and end up compromising their goals.

BrightPlan does this hard work for you, providing a custom Investment Plan for each goal. The aim of our Investment Committee is simple. To produce returns on your investments that help you reach your goals, all at a level of risk that is prudent. We balance risk and return by constructing diversified portfolios in line with the findings of Modern Portfolio Theory.

What is Modern Portfolio Theory?

In 1952, Nobel Prize winner Harry Markowitz published a groundbreaking paper in the Journal of Finance entitled “Portfolio Selection.” In the paper he introduced the concepts of Modern Portfolio Theory (“MPT”). MPT upset traditional portfolio selection theories of the time that focused on striking it rich by carefully selecting a few winning investments.

Markowitz rightly observed that focused portfolios could offer high returns, but also carried a lot of risk. Limiting holdings to a few strategic bets effectively meant putting all of your eggs in one basket. He wanted to help people to be investors, not merely speculators. That meant considering both returns and risk.

Instead of just focusing on individual investments within a portfolio, Markowitz took a panoramic view of how entire portfolios fit together. He suggested that not all returns are created equally.

To construct the ideal investment mix, he argued, both the expected returns and the overall risk of the entire portfolio should be calculated.¹ The best portfolios would offer the highest potential returns for a given level of risk. And there was even better news. For inefficient portfolios, overall risk could be reduced without significant cuts to returns, or returns could potentially be improved without adding greater risk.

Tenet #5 - Practice Smart Diversification

Markowitz suggested risk could be reduced in portfolios by using “the “right kind” of diversification for the “right reasons.”² The right kind of diversification means looking beyond the number of holdings in a portfolio, drilling down instead into the types of holdings in the portfolio.

For instance, holding 30 highflying tech stocks prior to the Dot-com crash in 2000 just meant investors had 30 eggs in the same basket, not 30 different baskets. Pseudo-diversification meant when the Tech Bubble popped, that nest egg looked more like a scrambled egg.³

Building a truly diversified portfolio requires access to a broad range of holdings within any given asset class (or group of investments). Stocks are a core asset class in many portfolios and can be diversified among various sectors (e.g. utilities, healthcare, financials, or technology), company sizes (small vs. large cap companies), and countries (U.S., foreign developed, or emerging markets).

Diversifying between sectors, sizes, and countries in your portfolio can reduce the risks associated with being overly concentrated in one area. Broad diversification also offers the upside of capturing the returns of top performing markets and sectors around the world.

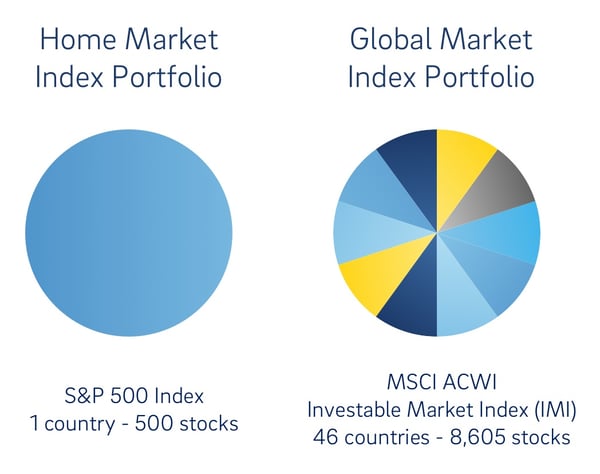

BrightPlan portfolios are globally diversified, ensuring that our clients don’t risk too much on one hot trend, or miss out on broader market returns. The chart below shows the world of opportunities for a U.S. investor who looks beyond her home market.4

One More Layer of Diversification

Smart diversification spreads out investments within a specific asset class, like the stock example above, and goes further by dividing a portfolio among various asset classes. The technical term for this is “asset allocation.” Even though it has a weird name, the way you divvy up your portfolio is one of the most important investment decisions you will ever make.

At the most basic level, we diversify our portfolios across a global mix of equities (stocks) and fixed income (bonds). Generally, the primary purpose for the equity allocation is capital growth (return generation). The primary purpose for the fixed income allocation is capital preservation (reducing risk).

As Harry Markowitz learned, risk and return are closely related. The compensation for taking on increased levels of risk is the potential to earn greater returns. See the chart below for a simplified view of how different mixes of stocks and bonds impact risk and return.

As you can see, the all stock portfolio offers the highest return but will also experience greater fluctuations over the course of a year. Stocks are the roller coaster of asset classes. As you introduce bonds to the portfolio, the potential return decreases, but volatility smooths out as well. Volatility isn’t the enemy, it’s the cost of higher returns.

So how can you apply the wisdom of diversification to your situation? For an investor with a high risk tolerance and a distant goal, like saving for retirement, a higher proportion of the portfolio could be allocated to riskier assets, such as equities. With a near term goal like an upcoming home purchase, a protective portfolio of bonds and cash can give greater stability and less stress.

There is no “one size fits all” approach to asset allocation. Modern Portfolio Theory is beautifully versatile! Using MPT, BrightPlan portfolios provide an ideal mixture of assets for each of your goals based on your risk tolerance and financial situation.

Diversify to Reach Your Goals

We never forget the point of investing. Our aim is to help you fund your future. We diversify portfolios because markets are unpredictable, knowing that smart diversification within and among asset classes maximizes the likelihood of reaching your goals. Our technology helps you build an investment plan, so you can just plan for life.

A few very important decisions remain, and we cover them in the final part of our evidence based investing series, Focus On What You Can Control.

---

1) Modern Portfolio Theorists use Mean-Variance Optimization (MVO) to calculate the “efficient frontier” of best portfolios. Don’t let the name intimidate you. Statisticians calculate the Mean of past growth in an asset class to represent the return, and the Variance as a statistical measure of risk. Put them together and bam! You can mathematically quantify risk and return. This allows you to measure one portfolio against another.

2) Markowitz, H. (1952). Portfolio Selection. The Journal of Finance 7(1), pp. 77-91.

3) Diversification can reduce risk but cannot completely eliminate risk. Markowitz later differentiated between systematic (or market) risk, and diversifiable (or specific) risk. Specific risk is the risk associated with one company, such as slowing earnings due to competition, a strike by workers, or a product recall. This risk can be reduced by diversification. Systematic risk cannot be diversified away, it is common to all securities. Systematic risks include recession, inflation, or wars.

4) Source: Dimensional Fund Advisors, “Pursuing a Better Investment Experience.” 2016