Three ways to make the most of your Recovery Rebate check

Daniel Lee, CFA, CFP®

91% of American families are estimated to receive a check from the US government as part of the $2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act1. The average Recovery Rebate check is expected to be $1,7292 depending on family size and income, and some Americans may get them as early as mid-April.

Your first priority: taking care of immediate needs

The rebates are a welcome relief for millions of Americans that are out of work and in financial distress due to the COVID-19 pandemic and resulting shelter-in-place orders. If you are struggling to make ends meet right now, you know your needs better than anyone else. However, proceed with care as you replenish and stock up on your essential needs. Even those of us who are typically good at budgeting can make poor decisions when financially stressed, according to a study by Harvard professor Sendhil Mullainathan.

“When you have scarcity and it creates a scarcity mindset, it leads you to take certain behaviors which, in the short term, help you manage scarcity but in the long term only make matters worse.”

Sendhil Mullainathan3,4

The best way to overcome this is to have a plan for your cash before it arrives. Make sure all of your essential needs are met by first making a checklist of all of your immediate needs. Then think about longer-term needs, such as gas for your car next week or medication that you may need to refill next month. Remember to leave some of the rebate in savings just in case you forgot something or there is an emergency.

If you’ve lost your job due to the pandemic, the CARES Act has expanded the number of people that are eligible for unemployment benefits and significantly increased how much you can get and for how long. It is recommended that you apply for benefits as soon as possible to see if you are eligible. More information is available at this U.S. Department of Labor sponsored website.

Why you need to have a plan for the money ahead of time

Able to meet your essential needs without the help of the stimulus money? Great, there are still two reasons that planning ahead can lead to better financial decisions. First, family taking care of sick members, parents working from home while taking care of their kids, doctors and nurses working long hours on the frontlines, are just a few examples of people stressed for time. Scarcity of time, like money, can lead to poor financial decisions.

Second, a study by Richard Thaler, a Nobel winning behavioral economic professor, illustrated that participants committing to a specific future action at a specified time were able to better achieve desired outcomes5. Planning ahead is one of the best behavioral nudges that can help achieve your goals because it removes one of the biggest obstacles, your future self!

Here are three suggestions on how to make the most of your rebate as you look ahead.

1. Consider starting or adding to your emergency savings account.

My students like to call this a “peace of mind” fund, and the importance of having enough in case of an emergency cannot be stressed enough. This pandemic has shown that things can change very quickly, and without an emergency fund, it is easy to spiral down a dark path of unhealthy credit card debt or suboptimal 401(k) loans. We recommend having enough to cover your essential needs for three to six months, and in some cases even twelve months. An emergency fund may even help you find a new dream job.

2. Invest it.

If you have ample savings for immediate needs, consider investing the rebate. It is human nature to spend this money on things you normally would not because it feels like a “bonus”. Reframe the rebate as part of your regular income and put it towards achieving one of your goals. Your rebate increases by $500 per eligible children. If you have young kids, consider investing their rebate in a 529 plan.

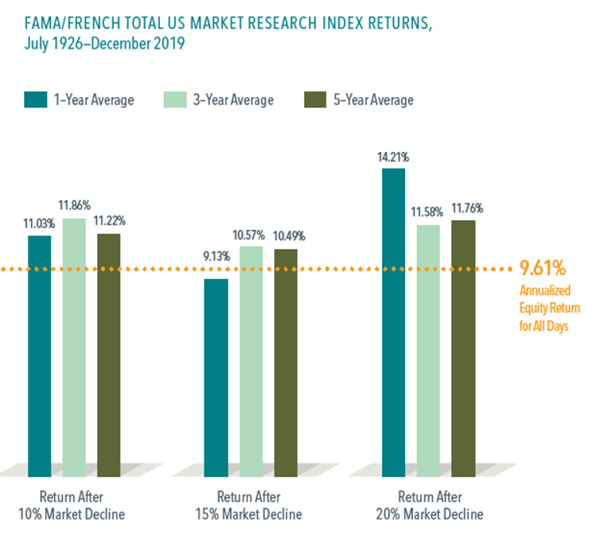

It can be scary to invest when the stock market is down 20% or more. However, historical data shows that after market declines, the average gains in subsequent years can be relatively robust. That may indicate that for long-term goals, now can be a particularly good time to put your money to work by investing it in the stock market.

Average Stock Market Returns After Decline

Source: DIMENSIONAL FUND ADVISORS. Average Stock Market Returns After Decline (Fama/French Total US Market Research Index Returns, July 1926–December 2019).

Source: DIMENSIONAL FUND ADVISORS. Average Stock Market Returns After Decline (Fama/French Total US Market Research Index Returns, July 1926–December 2019).

3. Help those in need.

The CARES Act provides a small tax incentive by giving a tax break for donations up to $300 to a qualified 501(c)(3) charity even if you take the standard deduction. Many charities have created special funds to support seniors, the homeless, and other vulnerable members of our society during the COVID-19 pandemic. Charity Navigator is one of many resources that are available online to help you research and verify charities.

You can also support workers that are fighting the pandemic on the frontlines. University hospitals have created COVID-19 Response Funds where you can donate, and charities such as Frontline Foods are accepting donations to provide meals to healthcare workers while also supporting local restaurants.

Donations are not the only way to help those in need. Small businesses are some of the most heavily impacted by the COVID-19 pandemic. Consider supporting your local businesses by making purchases at their stores with part of the rebate. Purchasing gift cards online for the future is also an option if you would like to help while minimizing contact. Some websites that can help you search for gift cards at your favorite local restaurants are below:

- San Francisco Bay Area: https://saveourfaves.org/

- New York: https://helpmainstreet.com/

- Multiple cities: https://supportlocal.usatoday.com/

This is a difficult time for many people around the world and staying healthy is, and should be, our primary concern. However, we cannot ignore the financial implications of the pandemic and bad financial decisions will only exacerbate our problems. Plan ahead for your recovery rebate and avoid the trap that can lead smart people to make poor decisions when stressed for money and time.

Disclaimer: This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

Sources:

1, 2 https://www.aei.org/economics/the-care-act-who-will-get-a-rebate-and-how-much/

3 Mullainathan, Sendhil; Shafir, Eldar; Mani, Anandi; Zhao, Jiaying (30 August 2013). "Poverty impedes cognitive function". Science.

4 https://www.npr.org/transcripts/520136937

5 Thaler, Richard H. and Cass R. Sunstein. 2008. Nudge: Improving Decisions about Health, Wealth and Happiness. Yale University Press.