What to Do With Your Old 401(k)

Jeff Clark, CFP®

When you land a new job, you get to leave a lot behind. Your old boss, your stapler, and sometimes your sanity. But one thing you shouldn’t leave behind is your 401(k).

After you leave a company you have a few options for your 401(k):

- Leave it with your previous employer

- Roll the balance into an Individual Retirement Account (IRA)

- Roll the balance into your new employer’s 401(k)

- Withdraw the funds (not recommended)

Many people choose the first option, letting their old 401(k) gather dust in a previous employer’s plan. While this is the easiest path, it’s not always the best.

- You could forget about it

- You might pay higher fees than you need to

- Multiple retirement accounts can be difficult to manage

- Limited investment options

A huge advantage of a 401(k) is that it puts you in the driver’s seat when saving for retirement. You get to decide how much to invest from every paycheck. When a 401(k) gets left behind you lose that control.

Taking a few minutes to roll over your 401(k) puts you back in charge, and comes with a handful of other benefits you should consider. If you have an old 401(k), here are a few reasons to get that rollover rolling.

#1 Lower Overall Fees

A recent study from TD Ameritrade found that 37% of 401(k) participants thought they were paying nothing in 401(k) fees, but that couldn’t be further from the truth. The cost of owning a 401(k) varies widely, and the fees aren’t always easy to find.

These fees often come directly out of your account, so it can be hard to keep track, but the main ones to look out for are:

- Investment fees: Usually the largest portion of your fees are charged by the funds in your plan. The expense ratio is the most common and is an annual percentage that can range from 0.01% to 1.5% or more.

- Administration fees: Paid to the bank or other financial institution managing your 401(k). Admin fees cover record-keeping, accounting, legal and trustee services. Usually this is a flat dollar cost that is divided among employees.

- Other fees: Primary culprits are service fees for taking a 401(k) loan, advisory fees for additional guidance, front or back-end sales charges, and fund marketing fees (12b-1 fees).

Fees add up, especially for smaller plans. The average all-in costs for companies with 100 employees come out to 1.18% per year.2

The benefits of having a 401(k) with your current employer generally outweigh the impact of fees (tax savings, high contribution limits, company match, etc.). But when you move to a new employer, paying high fees in the old 401(k) is hard to justify. Moving your nest egg elsewhere could protect it from excessive annual fees.

#2 More Investment Options

A 401(k) will typically have a limited set of investment options, between 3 and 20 mutual funds to choose between. But have you ever wondered who decides which funds go in your 401(k)? It’s often the fund company administering your 401(k).

That could be an insurance company, a bank, or a brokerage firm, and each 401(k) administrator has funds with different fees and performance. If you keep your 401(k) where it was, you continue to be limited to these investment options, but a Rollover IRA gives you way more options.

#3 Keep Your Account Growing Tax-Deferred

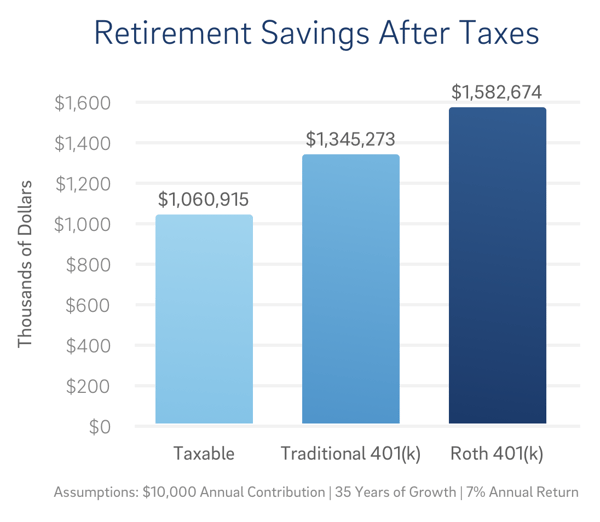

The massive benefit of investing in a 401(k) is the tax advantages of the account. These tax advantages help you to grow more wealth for retirement than you could in a taxable account.

When you do a direct rollover from your 401(k) into another tax-advantaged account, (whether it’s a new employer’s 401(k) or your own Individual Retirement Account), your money can continue compounding until retirement without a chunk of taxes taken out every year.

#4 Consolidate Retirement Savings

The days of staying with one employer for decades and retiring with a gold watch and a pension are all but over. According to the Bureau of Labor Statistics, the average employee will have between 12 and 15 jobs during their working years.3

No one wants a dozen different retirement accounts, and this is where a Rollover IRA can be so useful. Any time you leave an employer you can roll funds into this account, creating your own personal pension. It’s a portable retirement account that can be the final home for each 401(k) you own during your career.

#5 Continue Contributing for the Long Term

When you leave an old employer you’re cut off from contributing to their 401(k). That’s because the only ways to contribute to a 401(k) are from an employer match or directly from your paycheck from that employer.

A Rollover IRA is different. Anyone can contribute up to $7,000 of their earned income to an IRA for 2024. And depending on your income, your IRA contributions may be tax deductible.

If you’re older you can contribute an additional $1,000, raising the limit to $8,000. This allows you to continue building retirement assets with the double benefit of regular contributions and investment growth until you’re ready to retire.

Take 20 Minutes to Rollover

So next time you roll out from a company, rollover that 401(k). If you’re wondering how, BrightPlan can help. Investing in an IRA through a service that offers sophisticated, tailored financial advice gives you the peace of mind that your retirement goal is on track.

We’ll guide you to open a Rollover IRA at TD Ameritrade, rollover your 401(k), and invest your money in a diversified portfolio that holds stocks and bonds from around the world.

BrightPlan monitors and manages your account as markets shift, and you can speak with a financial advisor from Plancorp about your other retirement questions, like how to make the most of retirement benefits at your new company.

[1] TD Ameritrade, Three-Quarters of Americans Are in the Dark When it Comes to 401(k) Fees.

[2] 401k Averages Book 2018.

[3] Bureau of Labor Statistics. Number of Jobs, Labor Market Experience, and Earnings Growth Among Americans At 50: Results From A Longitudinal Survey. 2017.