5 Reasons to Open an IRA and Max it Out Every Year

Jeff Clark, CFP®

The Individual Retirement Account (IRA) is perhaps the best retirement savings tool.

An IRA is like an IOU for your future. You invest in the account today, and with the help of years of compound interest you may end up drawing on substantial savings when you’re ready to retire.

IRAs are packed with benefits. They can help you save more for retirement, are available to anyone earning income, and are cleverly designed to keep your hands off your money until you need it in your golden years.

Ready to dive into the details? Here are five reasons to open an IRA today and contribute as much as you can each year.

Reason #1: Tax Benefits - Now or Later

An IRA is a tax-advantaged account where you can set aside funds to grow for retirement. Uncle Sam set them up as pensions became less popular to help ordinary savers accelerate toward retirement.

The two most common types of IRAs are traditional and Roth. They both have tax benefits – traditional now and Roth later.

Now: Get immediate tax breaks when you set aside up to $6,000 per year in a traditional IRA. Your contributions may be deductible from your taxable income, and your investments can grow without being taxed until you withdraw from the account in retirement.

Later: A Roth IRA does not have up-front tax benefits. You deposit after-tax dollars (like a normal savings account), but may never have to pay taxes on that money again. You won’t be taxed on the investment growth over the years and won’t even pay taxes when you withdraw the money after retirement.

Before you get too excited, there is a bit of a catch for both accounts above. The IRS has limits on the deductibility of traditional IRA contributions and income limits for contributing to a Roth IRA. Before opening an account, read up on those limits in "Should I Invest in a Traditional or Roth IRA?"

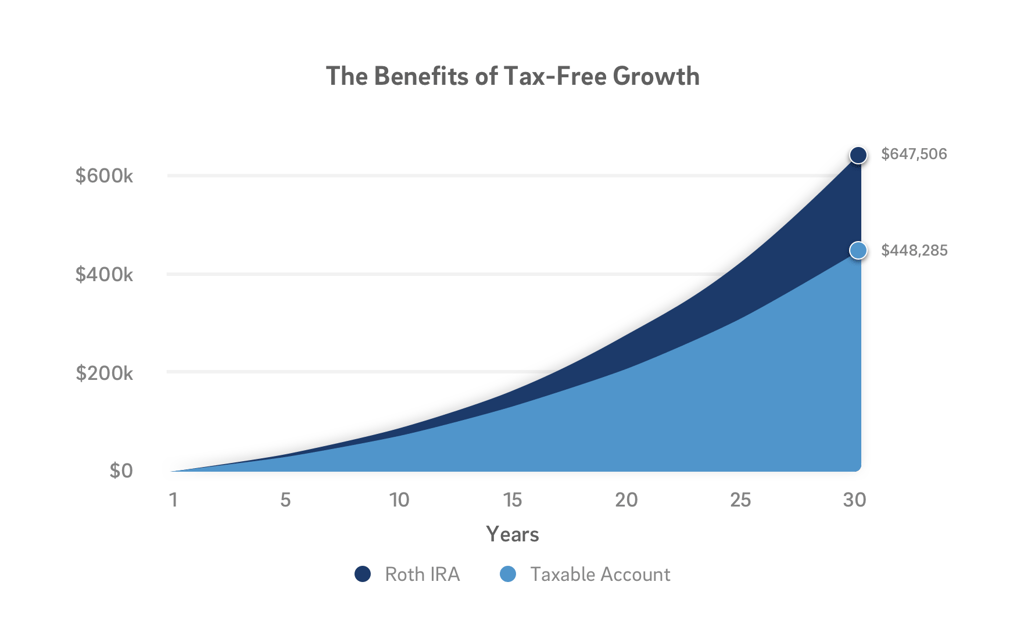

So, do these tax advantages really make a difference? Yes! Just look at the example below. It shows the difference between investing $6,000 in a Roth IRA or in a taxable account each year for 30 years. The benefits of tax-free growth and tax-free withdrawals add up to a nearly $200,000 advantage for the Roth. Remember, max it…don’t tax it.

Assumptions: This chart is for illustrative purposes and does not represent an actual investment. Assumes a 7.8% annual return in each account over the 30 years. The annual investment growth in the taxable account is taxed 25% at the end of each year and the Roth IRA is never taxed.

Assumptions: This chart is for illustrative purposes and does not represent an actual investment. Assumes a 7.8% annual return in each account over the 30 years. The annual investment growth in the taxable account is taxed 25% at the end of each year and the Roth IRA is never taxed.Reason #2: Flexibility - Your Choice of Investment Vehicles

Another benefit of investing for retirement in an IRA is the vast array of investment options. This flexibility is one reason many people roll over a 401(k) from a previous employer into an IRA.

While 401(k) plans are a great retirement tool with higher limits than IRAs, they can also have higher fees and fewer investment options. 401(k) plans typically include a limited set of 20-25 mutual funds as investment options, and often have higher maintenance fees than an IRA.

On the other hand, funds in an IRA can be divided among individual stocks, mutual funds, ETFs, and real estate investment trusts. Having more options puts you in the driver’s seat, and allows you to create a portfolio tailored to your retirement.

When you open a BrightPlan IRA, we’ll help you build a portfolio with the appropriate amount of risk for your goals and investing experience, allocated to low-cost mutual funds that invest in stocks, bonds, and real estate.

Reason #3: Availability - Whether Employed or Self-Employed

According to data from the U.S. Census Bureau, only 32% of Americans are saving for retirement in an employer 401(k) plan. That leaves many people without access to a 401(k) plan, including contractors, freelancers, and many employees at small companies.

This is where IRAs come to the retirement rescue. An IRA provides a savings tool anyone can use to put earnings to work. Even if your employer offers a 401(k) plan, you can also have a separate IRA.

Reason #4: Illiquidity - You Can't Touch This... For Now

While illiquidity sounds like something you drank made you sick, it really means “hands off!” The IRS has established strict rules and penalties for early withdrawals from IRAs, designed to keep your funds safe over the long term until you need them.

If you withdraw from an IRA before turning 59½, you can be subject to an early withdrawal penalty of 10%. This will make you think twice before tapping into your retirement savings for an impulse buy. The goal is to set your funds aside and forget about them until one day, your IRA is available for your retirement life.

With that being said, the IRS has created a few exceptions that can let you tap into IRA funds early, things like purchasing a first home, major medical expenses, or a sudden disability.

Reason #5: Use It Or Lose It - Today is The Day

It’s important to remember one scary fact – you can’t make up lost ground with IRA contributions. The limit for annual contributions bumped up to $6,000 for 2019. You can either use it or lose it. Every tax day the advantage expires for the previous tax year, and you cannot recover that advantage in future years.

Let’s say you decide to wait ten years to invest in an IRA. There’s no going back to fund your IRA with $60,000 for the years that were skipped. On top of the missed tax benefits, money put in a decade later won’t have the benefit of years of potential growth from dividends and appreciation.

While you can’t go back and save for years gone by, you can start saving today. As the saying goes, "The best time to plant a tree was 20 years ago, the next best time is today."

Even if you can't max out an IRA, saving what you can right now lets you take advantage of all of the benefits an IRA provides. So take some time to plant that IRA tree today. you’ll thank yourself 20 years from now.