Automate Your Investing With Dollar Cost Averaging

Jeff Clark, CFP®

When you look at the numbers, it’s tough for the average American looking to invest.

- 38% of Americans don’t own any investments¹

- The average personal savings rate is 7.5%, well under the recommended 15-20%²

- The average stock fund investor gained 4.9% over the past 10 years, while the S&P 500 gained 8.5%³

These trends are concerning because regular, disciplined investing is key to building long-term wealth. Many solutions could be offered to combat these issues, but a simple strategy we consistently recommend to clients can help with all three. It gets you invested quickly, automates a higher savings rate, and avoids the emotional decision-making that can lead to underperformance.

The strategy is dollar cost averaging, and if you hope to be an “above average” investor read on to learn its powerful benefits.

What is Dollar Cost Averaging?

Dollar Cost Averaging (DCA) is an investment strategy where you invest an equal dollar amount over a set frequency, usually on a monthly basis. A common example of dollar cost averaging is in your 401(k).

When you set up a 401(k) you elect how much money should be taken out of every paycheck. Then like clockwork that amount is deposited your 401(k) and invested into the funds you pre-selected. Whether the price is high or low in any given month, the same dollar amount is invested into the same funds.

It sounds simple because it is. It’s so simple it works, which is one reason that 401(k) accounts now hold an estimated $9.3 trillion (as of December 2022). Dollar cost averaging overcomes our natural inertia and concerns with investing by leading us to “precommit” to investing each month, without needing to make the decision on an ongoing basis.

The Benefits of Dollar Cost Averaging

Dollar cost averaging isn’t reserved for your 401(k). You can easily apply the same concept to your other investments. We recommend the DCA strategy because it has the rare combination of emotional, financial, and practical benefits. Here are a few:

Emotional Benefits: Build Experience Through Regular Investing

Dollar cost averaging can spare you some emotional turmoil when you’re just starting out with investing. Investing a little each month allows you to get slowly acclimated to short-term swings in prices and is less intimidating than investing a lump sum once a year or every few months.

I often liken dollar cost averaging to learning to swim. When you’re learning to swim, it’s natural to stick to the shallow end to get comfortable in the water. You don’t see new swimmers diving in the deep end. That’s a dangerous recipe for panic and a long-term aversion to getting back in the water.

Dollar cost averaging starts you in the shallows so you can have a better investing experience. Making consistent deposits allows you to build confidence and tolerance to the risk that comes with investing. Most investors will be at it for decades, so it’s okay to start slow, stay comfortable, and build confidence over time.

Financial Benefits: Avoid the Folly of Timing the Market

A second benefit of implementing dollar cost averaging is you don’t waste time and energy trying to time the market to get the best price. Instead, you just buy on a set schedule and focus on the long-term. No one truly knows whether the overall market will be up, down, or sideways on any given day. But over the long-term, as investors we expect stocks and bonds to give a return on our money.4

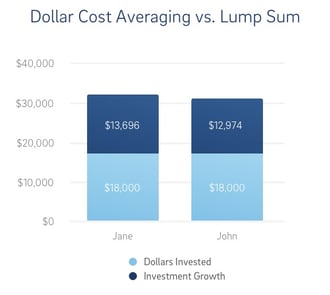

To illustrate the value of dollar cost averaging over time, let’s look at an example. Jane and John have an investment horizon of 15 years. They each plan on investing $1,200 a year, and their investments return 7% on an annual basis. Investor Jane decides to implement dollar cost averaging. She invests $100 at the end of each month. Investor John decides to invest lump sums of $600 in the middle of the year, and another $600 at the end of each year.

Even though they invested the same amount, Jane’s strategy of investing early and often through DCA left her with $700 more due to the additional time compound interest had to work on her deposits.5

Practical Benefits: Put Your Money to Work in a Natural Way

Finally, dollar cost averaging fits naturally with the flow of money in your life. Most people don’t have piles of money lying around. We earn money month by month and year by year. Dollar cost averaging is your way to make sure some of that money goes back to work for you, earning returns for your future.

And with modern investing infrastructure, automatic monthly deposits have made it easier than ever to pursue a dollar cost averaging strategy. At BrightPlan we encourage you to find ways to make Dollar Cost Averaging a breeze. When you set a goal, we recommend an investment strategy and suggest a monthly deposit amount. That way you can put cash to work in an appropriate investment strategy for your short- and long-term financial goals.

Here are a few examples of how you could potentially put your investments on autopilot using Dollar Cost Averaging.

- Contributing a fixed amount of money into a retirement account, such as a 401(k) or IRA, on a monthly basis.

- Investing a fixed amount of money into a mutual fund or exchange-traded fund (ETF) every month, regardless of the current market conditions.

- Setting up automatic investments into a brokerage account and investing a fixed amount of money into a specific stock or index fund at regular intervals.

- Purchasing shares of a dividend-paying stock on a regular basis, reinvesting the dividends received into additional shares of the same stock.

- Investing in a target-date fund, which automatically adjusts the asset allocation over time based on the investor's age and retirement goals.

- Regularly buying fractional shares of individual stocks through a brokerage account or investment app, gradually building a diversified portfolio over time.

- Investing in a robo-advisor platform that automatically invests money into a diversified portfolio based on the investor's risk tolerance and investment goals on a regular basis.

- Investing in a Health Savings Account (if covered by a high deductible health plan).

As you can see, there are many different ways to enjoy the benefits of dollar cost averaging, invest automatically for your goals, and focus on the more important things in life.

Sources:

1. A Snapshot of Investor Households in America, Finra Investor Education Foundation, 2015.

2. Personal Savings Rate Data,St. Louis Federal Reserve Board ALFRED, January 2019.

3. Dalbar Quantitative Analysis of Investor Behavior, 2018.

4. A more subtle benefit for investors in taxable accounts is that you’re able to buy at multiple prices, or different “tax lots.” When you invest a lump sum, you only buy each investment at that single price which doesn’t offer the flexibility that comes with dollar cost averaging. In taxable accounts, owning shares at different prices can help decrease the capital gains that are realized when you sell your investments, or provide tax-loss harvesting opportunities, which could mean a lower tax bill.

5. This time value of money calculation is a simple example where each investor started with a $0 account balance, both have a 15-year time horizon, assumed a 7% annualized return, and made deposits totaling $1,200 per year. Jane’s monthly deposits were made at the end of each month. John made semi-annual deposits of $600 at the end of the sixth month and the end of each year. 7% is not a guaranteed return and real results may vary depending on market conditions, how much is deposited, and how often deposits are made. This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. You should consult your own investment, tax, legal and accounting advisors.