Can You Achieve Your Financial Goals? Ask Mr. Monte Carlo

Jeff Clark, CFP®

Smart financial planning often means the timeline for your goals stretches decades into the future. The earlier you can plan for your goals, the better off you are. Planning ahead means you can spend, save, and invest strategically. And that longer timeline allows more time for the magic of compound interest to work on your investments.

But one downside of a long-term financial plan is that it introduces more uncertainty. A lot can change when you’re planning for a goal that’s many years away. Whether funding junior’s college expenses or retiring on a beach in Florida, the variables multiply and certainty diminishes. To plan with 100% certainty, you need to know:

—How much you can save month in and month out to the dollar (no emergencies allowed, thanks)

—What accounts to use and how the returns on any investments will be taxed (good thing taxes never change)

—The precise rate of return for those years for all associated investments (hint: not going to happen)

—The exact order of the returns year by year in a fluctuating investment (like a stock mutual fund)

—How costs for your goal will inflate over time (tuition, Florida housing, healthcare… everything)

Long-term planning is complex, because all of these variables are, well, variable. And yet these goals are too precious to just “wing it.” We need a way to make concrete money choices today based on an uncertain future. So how can you predict, or at least project, the unpredictable? Meet your new statistical buddy, Mr. Monte Carlo.

What is a Monte Carlo Simulation?

Monte Carlo methods were developed by physicists working on the first nuclear weapons in the Manhattan Project. Because the information was classified, it needed a sweet code name. The use of chance and random sequences in the calculations led to the title “Monte Carlo” after the Casino in Monaco.

Today, experts in many industries use Monte Carlo simulations to solve for problems with many possible outcomes. They’re the friends of:

- Weather forecasters showing a range of possible hurricane damages,

- Project managers estimating cash flows from a new product,

- Financial advisors considering how much savings a retiree can withdraw annually.

BrightPlan uses Monte Carlo simulations as a key indicator of whether you can achieve your financial goals. We can’t predict the future. So, for each goal we run a thousand simulations. The results reveal a range of probabilities: a forecast for your wealth.

Then, we use this data to determine whether the goal is on track, needs attention, or at risk. We consider a goal “on-track” when 75% of the Monte Carlo simulations either reach or exceed your target goal amount.

Behind the Scenes of a BrightPlan Monte Carlo Simulation

Our Monte Carlo simulation requires two sets of inputs, one from you and one from our investment team. You provide your current savings, monthly contributions, and when you’ll need your money.¹ We do the financial figuring behind the scenes of estimating returns on your investments, rebalancing parameters, taxes, and inflation.

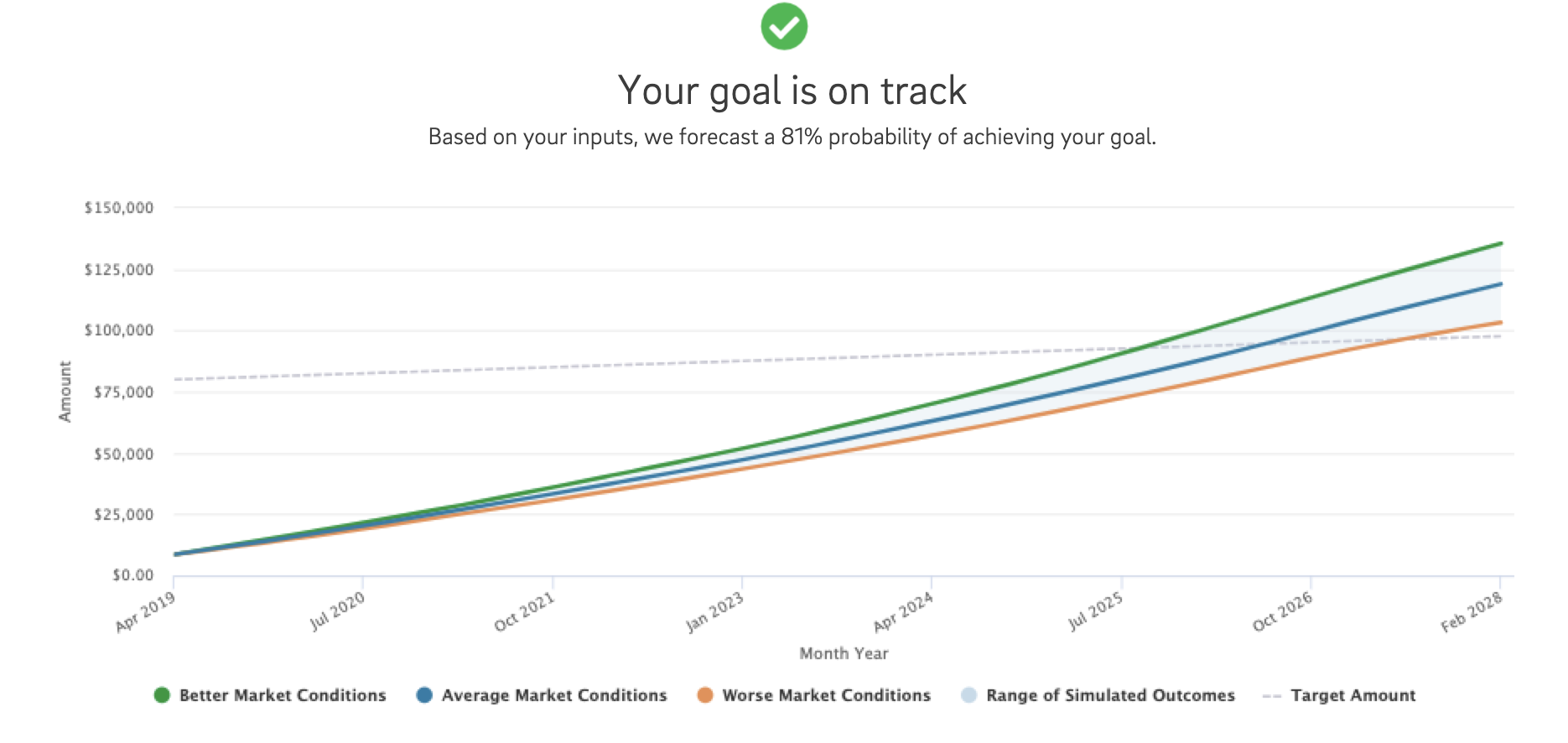

Then a powerful engine takes all of those inputs and generates a thousand potential outcomes for your goal. After running the simulation, we display the outcomes in a digestible format. The example below shows an example mountain chart.

The amazing thing is that you can adjust and recalculate the simulation in seconds. If you’re not happy with the result or hope to reach your goal faster, you can dream with the same tools a professional financial advisor might use.

By tweaking the inputs for your plan, like upping your monthly contribution, adjusting the investment portfolio, or toggling your withdrawal rate, you can make more informed financial planning decisions. That’s the power of Monte Carlo simulations: they give you a framework to translate chances into choices.

Best of all, your simulation is dynamic. Each day when you review your financial plan, we re-run the simulation for each of your goals, taking into account the latest data from your financial accounts linked to BrightPlan. This way you can quickly review how changes, like a big deposit to a retirement account or swing in the stock market, have impacted the probability of reaching your goals.

Two Risks of Monte Carlo Simulations

As with anything, you’ll want to be careful about going all in on the Monte Carlo. A Monte Carlo analysis is not a crystal ball; it’s more of a “best guess.” It’s important to remember that although a goal shows “on-track,” it is not a guarantee. However, as you get closer to your goal, the simulation will update and range of possible outcomes will narrow, becoming more accurate.

Second, Monte Carlo models are only as good as their inputs. Getting inflation wrong by a percentage point in either direction impacts your goal. Over-estimating long-term market returns for any of the components of your portfolio will inflate your estimated account value. Our investment committee makes their best estimates based on their research. They review, debate, and adjust them as necessary.

Why BrightPlan Uses Monte Carlos

While any statistical model has limitations, Monte Carlo analysis is one powerful tool among many for your financial planning arsenal. Individual investors are unlikely to have the expertise, tools, or patience to make these calculations. So, BrightPlan does the math for you and displays the information in a digestible format. We simplify the financial side, so you can focus on planning for life--or retiring in Florida.

[1] This could be a one-time withdrawal, such as for a down payment on a home, or a sequence of withdrawals for college tuition or retirement income.