What’s New in BrightPlan - Putting Budgeting Front and Center

Jeff Clark, CFP®

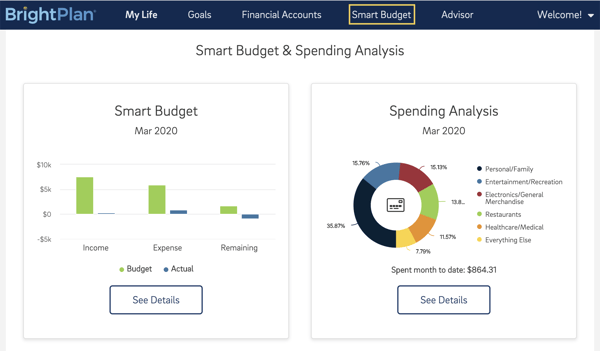

Our most recent release brings your budget front and center. Now you can easily stay on top of your monthly cash flow with your Smart Budget and Spending Analysis featured prominently on the My Life Dashboard.

We’re promoting these high-impact features because spending and budget are the most dynamic part of a financial plan. With the average American making 80 transactions per month across multiple financial accounts, these numbers shift every day.

Spending Analysis and the BrightPlan Smart Budget™ help you make informed choices based on deep insights into your earning and spending. Your navigation changed to highlight these features as well, with “Smart Budget” taking the place of the “Insights” tab on desktop. Tap the “Budget” tab on mobile for quick access.

Track Transactions with Spending Analysis

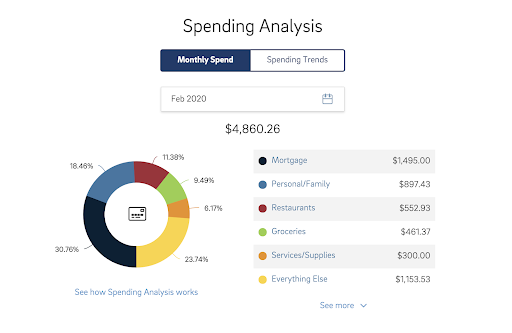

Spending analysis helps you get a handle on your spending in seconds, not hours. Just link your bank and credit card accounts to put BrightPlan to work. We fetch, categorize, and summarize up to 12 months of transactions for you to build a spending history.

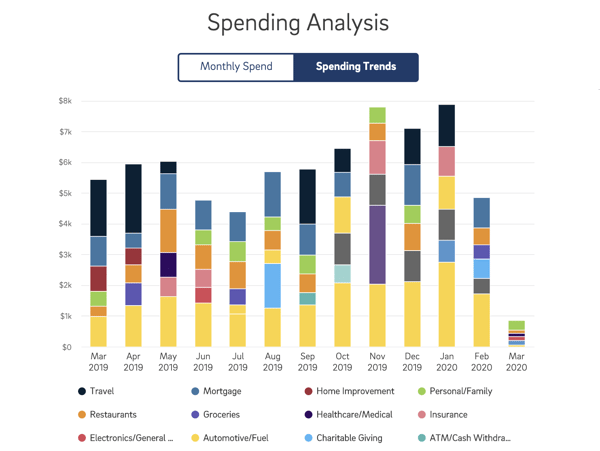

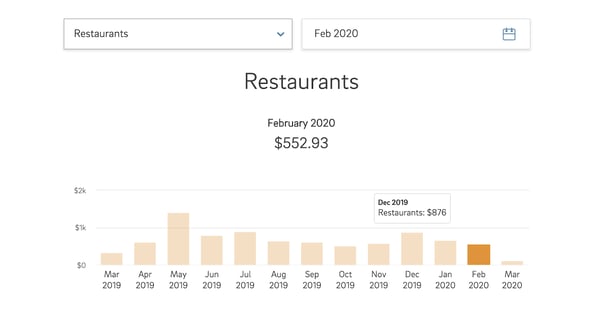

Spending trends visualizes your spending over the past year.

If one category is busting your budget each month (we’re looking at you Restaurants), you can check dig deeper to see individual transactions and check your spending trends in that specific area.

The simple act of reviewing your spending could make you think twice before swiping your credit card, help you cancel an unused subscription, or lead you to reconsider the value of some impulse buys.

The simple act of reviewing your spending could make you think twice before swiping your credit card, help you cancel an unused subscription, or lead you to reconsider the value of some impulse buys.

By looking at your goals and spending side-by-side in BrightPlan, you can discover how spending decisions today are impacting your financial future. As you spend more consciously, it's natural to free up more money to invest for your short- and long-term financial goals.

Even if your spending is under control, reviewing transactions regularly is a good discipline. A quick check can alert you to fraudulent transactions or keep you on top of sneaky money-pits like fees or unused subscriptions. With this feature on the My Life dashboard, it’s never been easier.

Say “Hello” to Cash Flow with Your Smart Budget

Spending is only one part of your financial picture. To really dial in your plan requires a close look at how your income and spending interact. A good budget doesn’t limit you. It frees you up to spend according to your priorities.

It’s a fine balance we all walk to assign part of our income to spending for the coming month, while leaving enough remaining to save for a secure and enjoyable future. The BrightPlan Smart Budget™ helps you quickly create a plan for your money so that you earn, save, and spend for maximum impact.

To generate your Smart Budget, BrightPlan analyzes up to a year’s worth of spending and income history in all bank and credit card accounts you've linked. Then, Smart Budget calculates your actual spending across twelve “Budget Buckets” to set preliminary targets for you. It’s easy to set up and easy to manage.

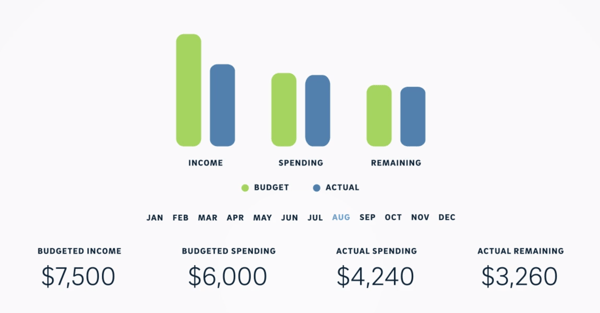

Your budget starts out high level, laying out your Income, Spending, and what’s leftover. Keeping an eye on these numbers is critical because your long-term goals and short-term needs compete for the same income.

You can adjust your budget numbers any time, but this way you’re putting the finishing touches on rather than starting from scratch. As each month progresses, you’ll see the Blue Bars representing your actual income and spending, stack up next to your green Budgeted Bars.

The philosophy behind Budget Buckets

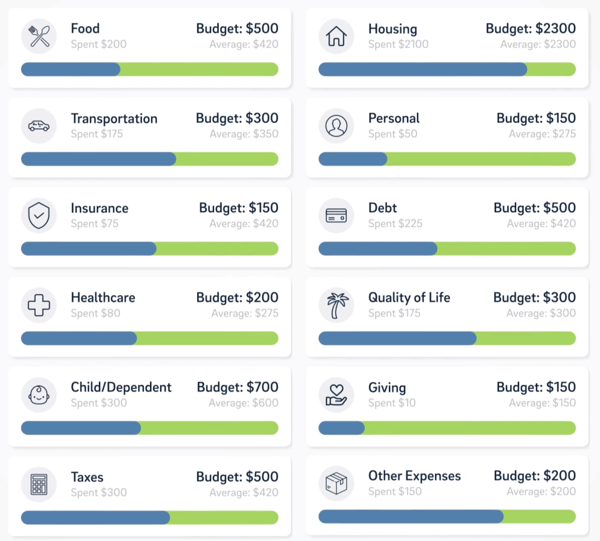

Most budgets are so complicated that people give up before getting to the good stuff. We kept Smart Budgeting simple by reducing the inputs to twelve “Budget Buckets.”

Each Budget Bucket is made up of multiple spending categories. That way you can easily glance at the big picture of your spending, set fewer targets, and measure what matters. The software does the heavy lifting here, calculating averages from your recent spending to create targets for each of the main categories of your Budget.

The 12 Budget Buckets

As you edit each Budget Bucket, your Budgeted Spending adjusts, so you can easily balance your budget. The objective is simple, adjust your spending to have enough “Remaining” at the end of the month to fund your important financial goals.

Hit your small goals to hit your big goals

Each month as you check your budget, you’ll gain new insights into your money. A Smart Budget gives you permission to spend, and stays up to date in the background when you do.

Every month you hit the small goals you set in your budget, you free up money for those large goals you’ve set in BrightPlan - whether it’s buying a home, a beach vacation, or retiring in style.

Where is Investment Analysis?

Your Investment Analysis is no longer visible in the Insights tab. To check your fund fees, asset allocation, and stock concentration, just navigate to the “Investments”

category from your Financial Accounts dashboard. This summary page isn’t just the new home for your powerful portfolio insights. You can see all of your investment accounts in one place along with their combined transactions, holdings, and valuation history.

Share Your Feedback

We enhance BrightPlan every month based on feedback from clients like you. What do you think of the new changes? If you have a suggestion or question, please reach out to us by using the Contact Us form in BrightPlan or emailing customer-service@brightplan.com. We look forward to hearing from you.