Supports and promotes 401(k) providers.

Employees want to utilize their benefits. That means they’ll have questions about those benefits and how best to implement them.

BrightPlan’s Financial Wellness Coach supports 401(k) providers by breaking down investment opportunities and providing personalized advice on how to best fund a 401(k). Think of the Coach as a supplementary guide that will help employees get the most out of their 401(k) benefits.

The more a person knows about their benefits, the more likely they are to take full advantage of them.

Unlike 401(k) providers who have a product to sell, BrightPlan is fiduciary. We work in your best interest without the upsell.

While companies like Fidelity Investments offer investing opportunities, BrightPlan does not. It’s complementary, not competitive. Using the Coach alongside a 401(k) provider is a great way to help employees understand and utilize their benefits.

Empowers users to make smart investments.

The Coach is an educator and mentor.

According to our 2024 Wellness Barometer, nearly 80% of workers have received bad financial advice. Employees that take full advantage of the Coach will receive practical guidance and advice specific to their situation.

While other AI chatbots may deliver shallow, one-size-fits-all tips for investing, the Coach actually teaches employees how to wisely invest so that they may do so confidently.

An empowered employee is more likely to engage with their 401(k) and make investment decisions.

Helps employees save and plan for the future.

In 2024, most workers expect financial planning benefits.

Though younger generations may be further from retirement than their baby boomer coworkers, they’re still very interested in preparing for the future while still enjoying the present.

BrightPlan helps employees save more so they can utilize their 401(k) at higher rates while still addressing current financial needs.

Offers tailored guidance customized to employee needs and goals.

The Coach is an ally in goal setting and achievement.

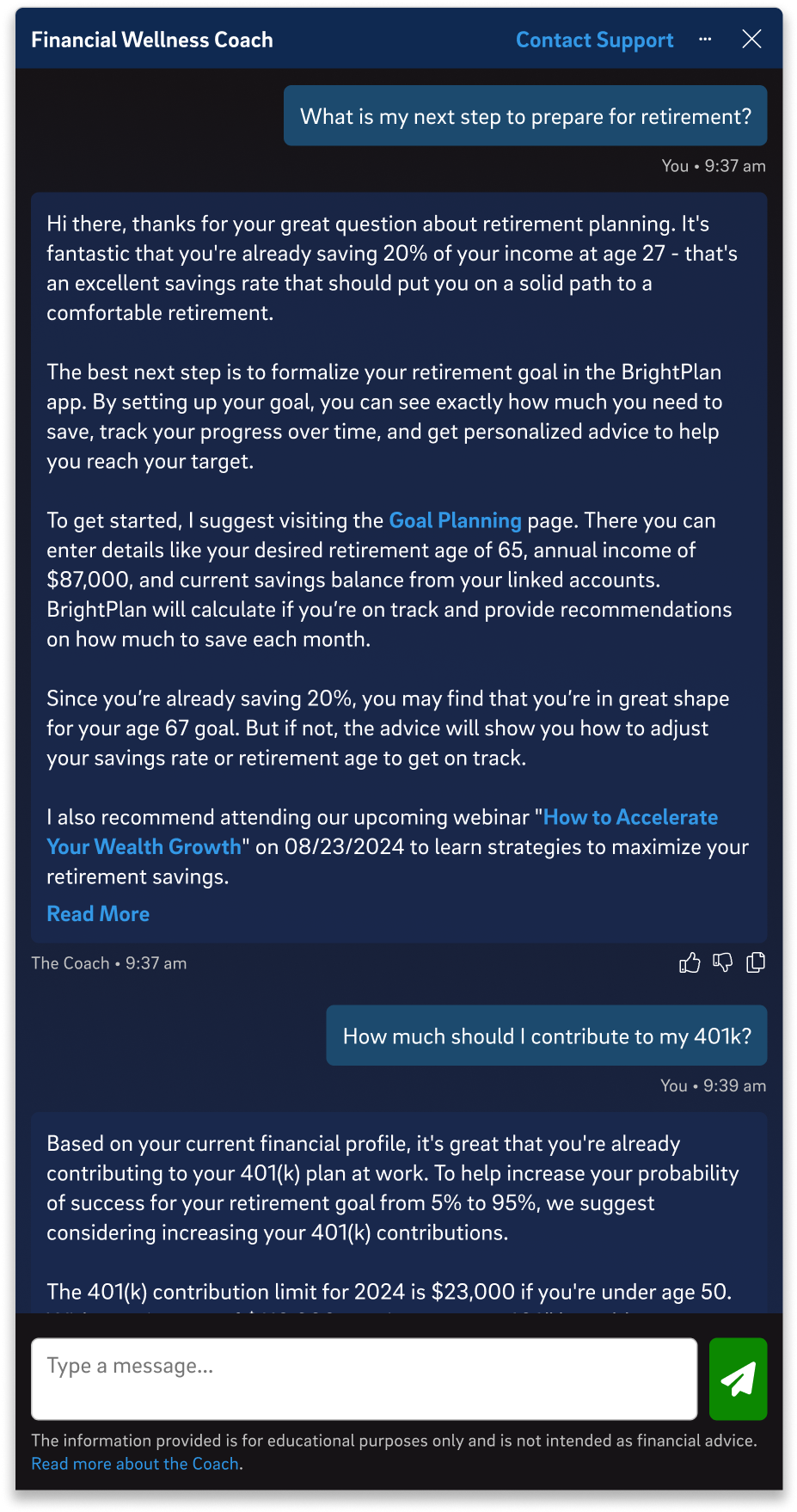

As the Coach receives more information about an employee, it will develop a realistic strategy that the employee can follow. Users with 401k benefits can track their goals and receive insights about their progress.

A 401(k) provider isn’t able to tell a client when they could increase their investment amount, but the Coach can. Because the Coach has a three-dimensional picture of a user, it can present opportunities based upon real-time changes in savings, income, and bill pay.

What can I do to prepare better for retirement?

Adding Your Benefits into the Coach

We can add your benefits package directly into the Financial Wellness Coach to act as your HR team’s front-line for benefit-related questions from your employees.

This means that when your employees ask their questions to the Coach, they will see real-time answers that are specific to their benefits options.

This helps your team save time by greatly reducing the number of inbound questions adding to their workload.

And your employees will have access to 24/7 responses for an amazing employee experience.

Stronger and more personalized benefit answers.

If your employees are fully utilizing their BrightPlan, the Coach can also provide additional clarity on benefit-related questions based on each employee's unique financial situation and goals. This level of personalization for each employee helps them understand how benefits are connected back to their finances and can help them achieve financial success.

Why do other benefit providers love BrightPlan?

As people leaders, you are trying to manage the realities of the business behind the benefits you are offering and the needs of your employees.

As an example, a 401(k) provider is looking to sell retirement investments to your employees. Some providers even offer financial planning resources as part of their offering. However, their goal is to help employees save money for the investments they offer.

BrightPlan only acts in the best interest of your employees (also called our fiduciary duty). We are not selling anything to your employees and the guidance provided is focused only on their financial goals. We work with 401(k) providers who love BrightPlan because we both recognize the need for employees to save for retirement. Having a plan for this important goal means that employees can focus on prioritizing it with their 401(k) provider, based on following their guidance from the Coach.

Tell me more about the Coach

BrightPlan’s patented Financial Wellness Coach provides financial guidance no matter where you live in the world and which language you speak. It is fiduciary in nature and provides real-time financial guidance, available 24/7. It leverages proprietary AI to provide responses. This technology is based on nearly 10 years of regulated and certified content, as well as visibility provided by employees into their financial situations and goals. If there is a preference or need to connect with an in-country advisor based on the question or request, the Coach will help the employee coordinate an appointment.