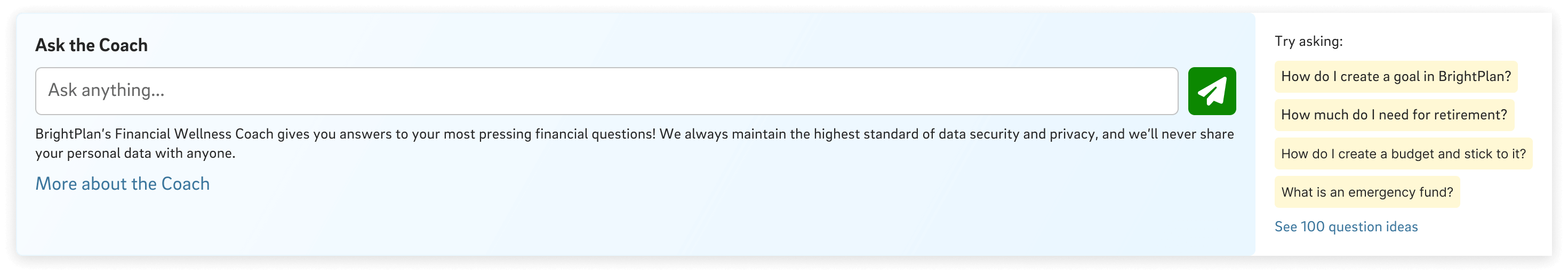

BrightPlan’s Financial Wellness Coach uses AI you can trust.

Instead of combing through search engines for keywords, the Coach includes information from certified financial advisors and your company policy documents.

So, when your employees ask the Coach a question, they won’t receive links to a random blog post. They’ll get a specific, actionable answer for their personal situation.

When employees link their accounts, the Coach delivers.

The Coach pairs information from over a decade of content from financial experts with the current state of each employee’s financial health.

Because the Coach will know what benefits a person selected and how they can best utilize them, employees can access pertinent, targeted guidance.

Take back time for your HR team.

When employees have questions about their benefits package, they typically contact HR.

But an influx of benefits-related questions only adds to the mountain of work HR has on a daily basis.

Adding Your Benefits into the Coach

We can add your benefits package directly into the Financial Wellness Coach to act as your HR team’s front-line for benefit-related questions from your employees.

This means that when your employees ask their questions to the Coach, they will see real-time answers.

This helps your team save time by greatly reducing the number of inbound questions adding to their workload.

And your employees will have access to 24/7 responses for an amazing employee experience.

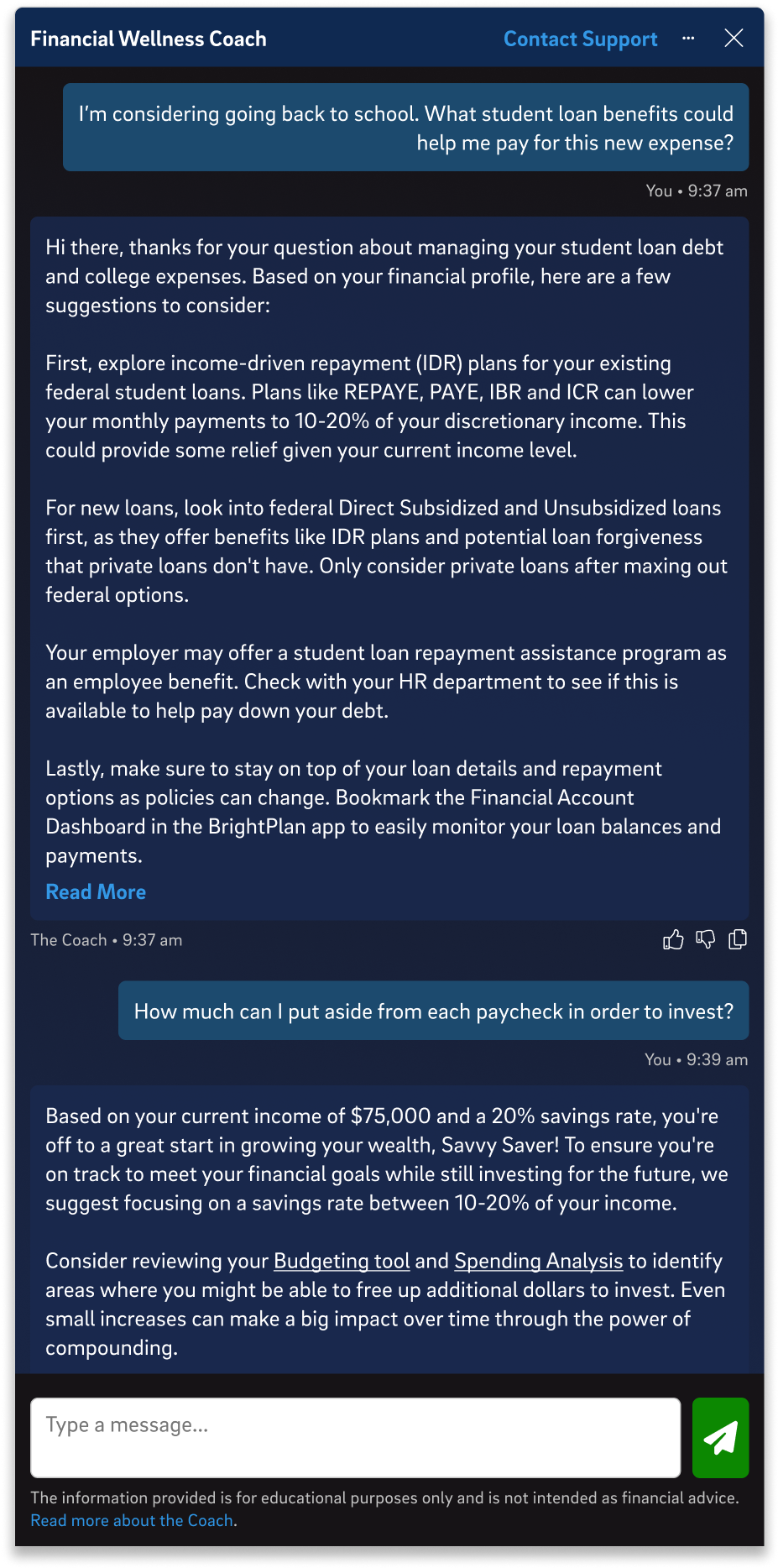

Stronger and more personalized benefit answers.

If your employees are fully utilizing their BrightPlan, the Coach can also provide additional clarity on benefit-related questions based on each employee's unique financial situation and goals. This level of personalization for each employee helps them understand how benefits are connected back to their finances and can help them achieve financial success.

Visibility and Adoption of Benefit Offerings

HR leaders are constantly trying to make sure employees have visibility on the benefit offerings they provide because benefits continue to be one of the top factors in employee retention.

This has become even more challenging with the amount of information shared with employees across the organization on a regular basis. However, access to the Coach creates a streamlined way to address a variety of financial situations with pertinent guidance.

When employees ask their money questions, the Coach will share relevant benefits information. This brings actionable insights directly to your employees exactly when they want it!

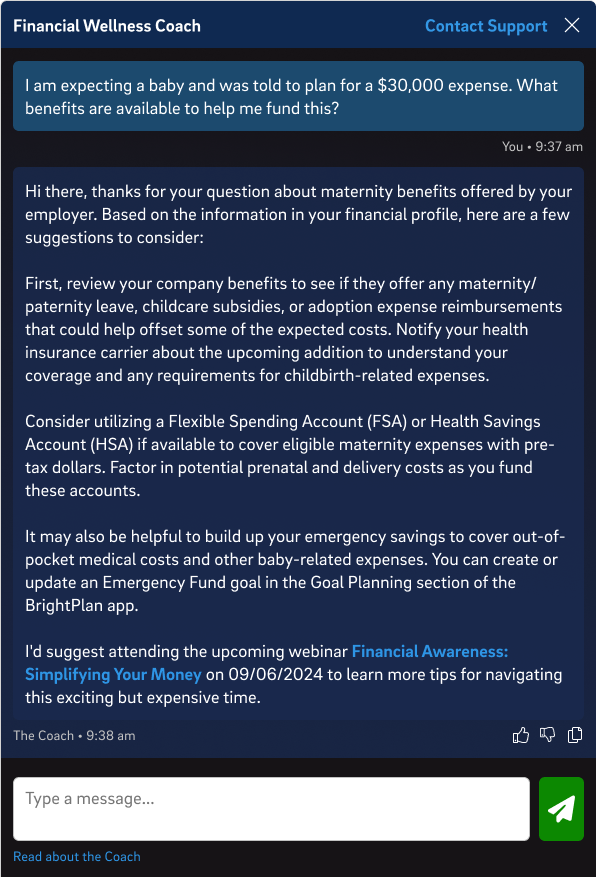

The Coach in Action

If the employee is wondering about retirement, paying down student loan debt, or saving for an upcoming major medical expense, the Coach will share your company’s benefit information.

The Coach will also guide your employees to read relevant articles and watch webinars with tips on other ways to proactively save money and stay on track with their personal financial goals.

By helping employees maximize their benefits, your HR team can improve their employee experience and help your talent acquisition team remain competitive with other offer packages that may prioritize sala

Why do other benefit providers love BrightPlan?

As people leaders, you are trying to manage the realities of the business behind the benefits you are offering and the needs of your employees.

As an example, a 401(k) provider is looking to sell retirement investments to your employees. Some providers even offer financial planning resources as part of their offering. However, their goal is to help employees save money for the investments they offer.

BrightPlan only acts in the best interest of your employees (also called our fiduciary duty). We are not selling anything to your employees and the guidance provided is focused only on their financial goals. We work with 401(k) providers who love BrightPlan because we both recognize the need for employees to save for retirement. Having a plan for this important goal means that employees can focus on prioritizing it with their 401(k) provider, based on following their guidance from the Coach.

Tell me more about the Coach

BrightPlan’s patented Financial Wellness Coach provides financial guidance no matter where you live in the world and which language you speak. It is fiduciary in nature and provides real-time financial guidance, available 24/7. It leverages proprietary AI to provide responses. This technology is based on nearly 10 years of regulated and certified content, as well as visibility provided by employees into their financial situations and goals. If there is a preference or need to connect with an in-country advisor based on the question or request, the Coach will help the employee coordinate an appointment.