Now more than ever, employees are looking for financial wellness benefits.

Planning for the future is especially important to millennials and Gen Z workers who are concerned about everything from home buying to retirement.

According to our 2024 Wellness Barometer Survey, a mere 18% of respondents had financial preparedness skills, meaning they had little to no insight on how to plan ahead without neglecting the present.

BrightPlan’s Financial Wellness Coach was designed to be an ally for all users. Not only does the Coach encourage healthy spending and saving habits, it can explain why those habits are beneficial.

The Coach will also provide goal-oriented road maps that are tailored to a person’s lifestyle.

Like your favorite human coach, our virtual Coach supports and educates the user so that they may thrive and enjoy a brighter financial future.

Big picture financial advising.

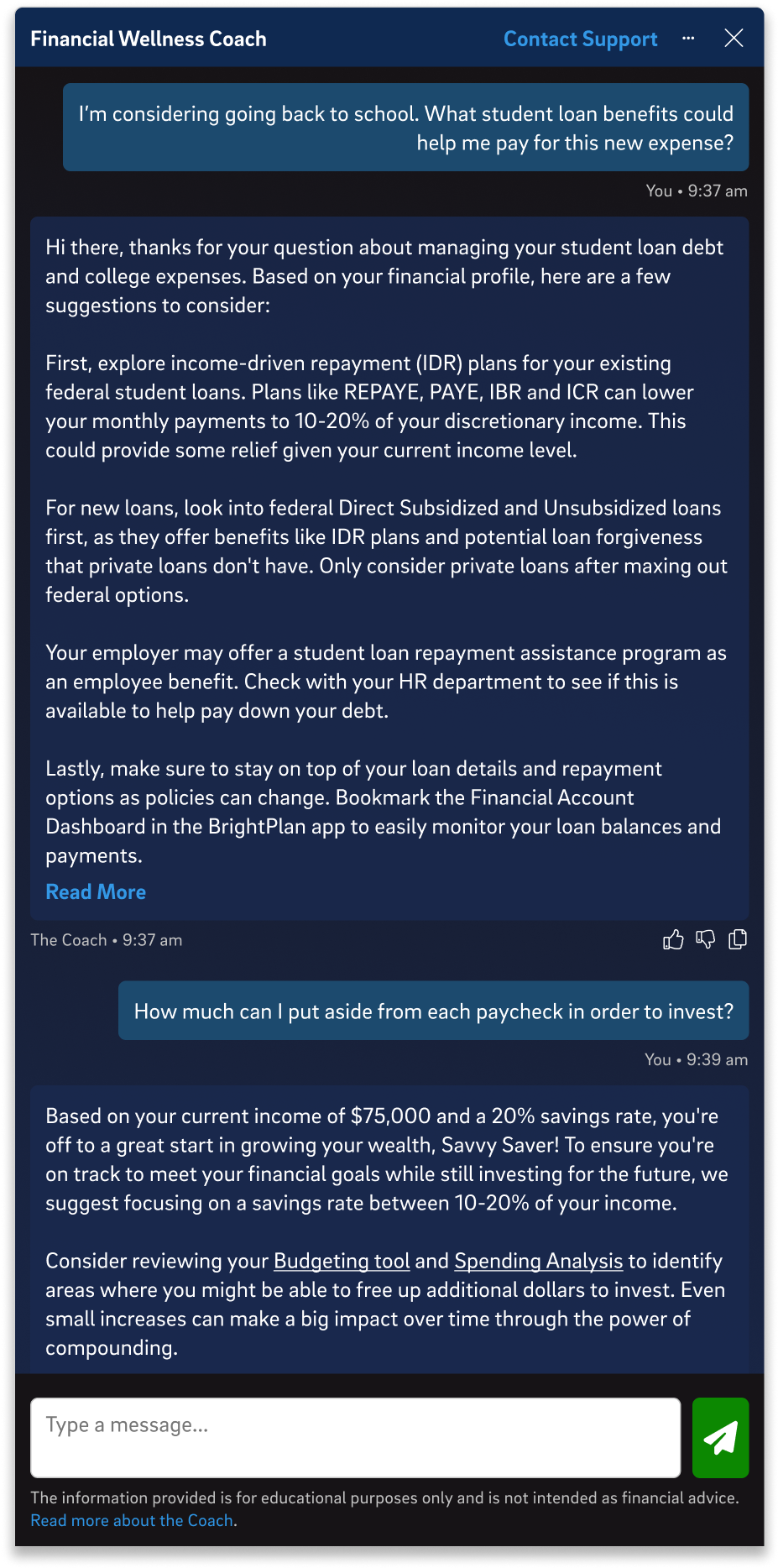

Specificity is what sets the Coach apart from your favorite search engine.

Instead of pulling snippets from random finance blogs that may not be fact-checked, the Coach draws upon the regulated and certified knowledge of expert financial advisors. Because the Coach is fiduciary in nature, it works in the best interest of the user.

Imagine an employee making $75,000 a year wants to know how much they should invest from each paycheck. If they receive general advice based upon a $100,000 yearly salary, it won’t do them very much good. The Coach takes income into account when providing guidance. It also looks at things like spending habits, bills, and credit to formulate rock-solid advice that will benefit the user.

Company-wide insights.

The Coach works in the user’s best interest and that includes the employers that offer it.

As the Coach interacts with employees, employers receive anonymous aggregated data that reflects common needs and concerns.

Though employers do not receive data on one specific employee, they get to see the larger picture in order to better understand their people in real time. These insights are incredibly important when deciding what benefits and training programs to offer.

Support for HR and benefits providers.

The Coach is an asset to employees, employers, and HR too.

Human Resources teams are constantly inundated with questions and requests. Additional emails about benefits information and implementation advice just add to an already jam-packed workload.

The Coach can help.

The Coach is available 24/7 and is capable of providing informative and tailored answers throughout the day as employees need them. Employees can skip the email to HR and get instant information that is not only accurate, but specific to them as an individual.

Tell me more about the Coach

BrightPlan’s patented Financial Wellness Coach provides financial guidance no matter where you live in the world and which language you speak. It is fiduciary in nature and provides real-time financial guidance, available 24/7. It leverages proprietary AI to provide responses. This technology is based on nearly 10 years of regulated and certified content, as well as visibility provided by employees into their financial situations and goals. If there is a preference or need to connect with an in-country advisor based on the question or request, the Coach will help the employee coordinate an appointment.