New Credit Utilization Feature Helps Clients Improve Credit Score and Lower Borrowing Costs

Shriraj Shah

Your employees have some pretty big financial goals, whether it’s paying for continuing education, or purchasing a new car or home. For many, these purchases require a loan and lenders look at an individual’s credit score when evaluating their credit worthiness.

Credit utilization is one of the biggest factors that impacts an individual’s credit score. It’s calculated by taking into account how much you owe on your credit accounts (credit cards) in comparison to your total available credit. Keeping your credit utilization below 30 percent can help you improve your score and lower your overall borrowing costs.

How BrightPlan helps

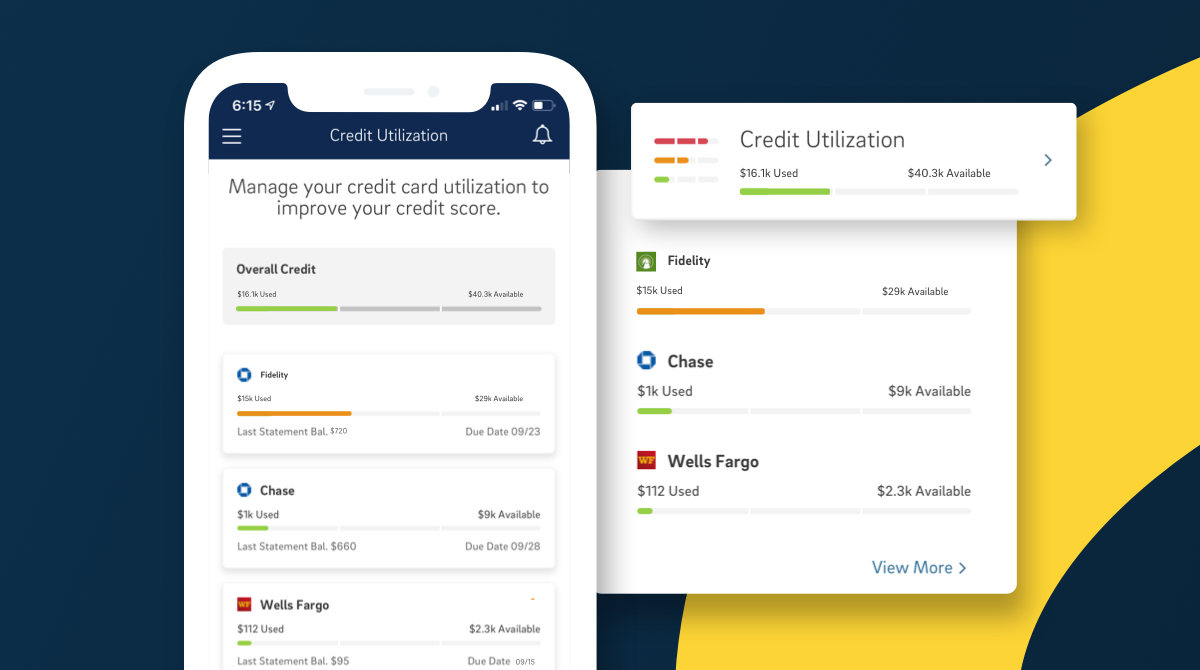

Our new credit utilization feature makes it easy for employees to track their credit utilization for each individual credit card they own as well as across their aggregate credit cards, so that they can make smarter decisions and improve their overall credit score. Employees get notified when they reach one-third of their credit limit, making it easy to course-correct and avoid potentially negative impacts to their credit score.

Sample data for illustration purposes only

Your employees will thank you

An improved credit score pays dividends, particularly on longer-term loans. Let’s look at an example:

Your employee is looking to secure a 30-year fixed rate mortgage for $300,000. Based on their current credit score, lenders are willing to provide them with a 4% interest rate. But, if they carefully build their credit and wait until it improves, they could get a 3% interest rate. When amortized over the term of the loan, this seemingly small difference in interest rate equates to several thousand dollars in savings.

|

APR |

Total cost over 30 years |

|

4% |

$515,000 |

|

3% |

$455,000 |

|

Total Savings |

$60,000 |

With this new product capability, BrightPlan continues to bolster its Total Financial Wellness solution, empowering employees with the tools they need to achieve their financial goals. By tracking credit utilization, employees can better manage their credit scores and decrease financial stress, which, in turn, helps improve workplace productivity and engagement.