The Total Value and ROI of Financial Wellness

Ariana Alisjahbana

Calculate the Total Value and ROI of Financial Wellness for your company now.

Many HR leaders understand the value of offering financial wellness benefits to their employees, but how do you measure the tangible value and return on investment (ROI) of these programs―especially when communicating to the C-suite?

Employees are increasingly demanding that their employers support them with their financial well-being. A recent survey found that 75% of employees believe that employer-sponsored financial wellness programs would help relieve financial stress. Employers are uniquely positioned to support their employees’ financial well-being as most of an employee’s financial life is tied closely to their employer as the primary source of income and benefits. Another recent survey found 62% of employers feel responsible for their employees’ financial wellness.

According to IDC, employer-sponsored financial wellness programs help create a robust employee experience, which in turn drives greater employee engagement, loyalty, and organizational resilience. Financial wellness is no longer a “nice to have” benefit―it’s a strategic imperative.

The ROI of Financial Wellness

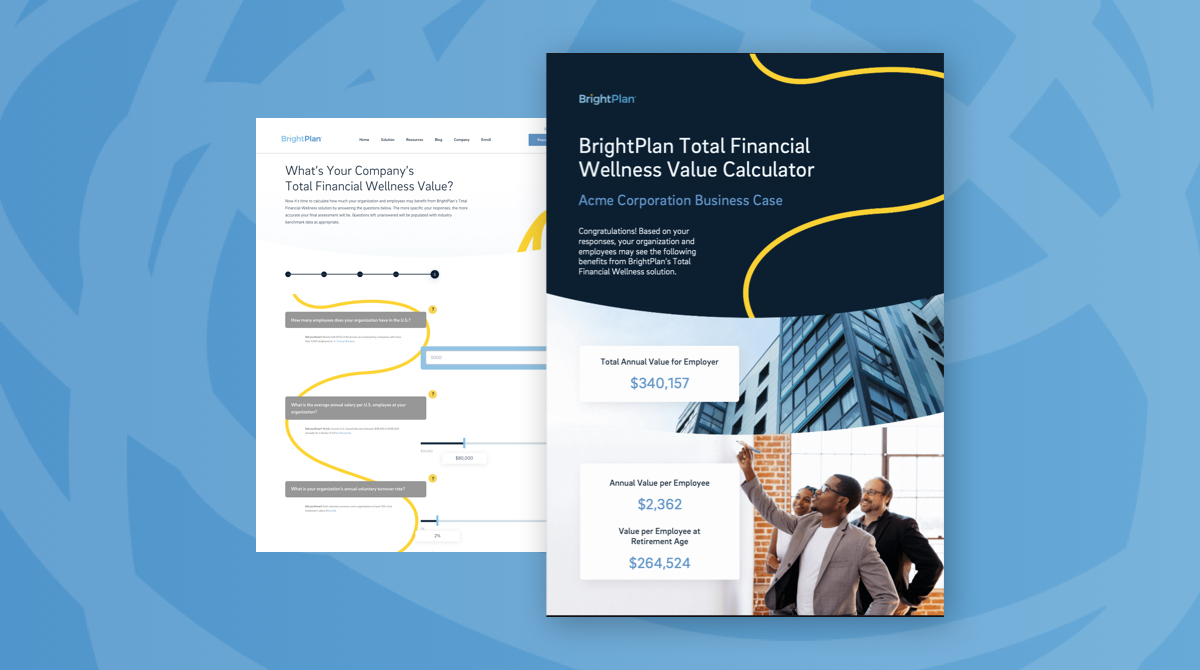

Employers often ask us about the ROI of financial wellness. They understand the value of these benefits conceptually but want concrete numbers to back it up. To answer this question, we created a free tool to quantify the potential value of BrightPlan’s Total Financial Wellness solution.

Our approach has two key components: the value for employers and the value for employees.

Employer Value

Many of the actions employees take to improve their financial well-being, such as increased savings in tax-advantaged accounts and retiring on time, can lead to tangible cost savings for the business annually.

Our approach calculates the potential annual financial wellness ROI for the employer, taking into consideration the following factors:

- Healthcare Premium Savings: Employees who receive financial advice may be more likely to choose Health Savings Account (HSA)-enabled health plans for their tax-advantages. These also cost less in premiums, leading to tangible cost savings for the employer.

- On-time Retirement: Employees often don’t retire on time even if they are financially ready, due to a lack of confidence in their financial plan or the complexity of such decisions. These employees cost employers money, from higher salaries and benefits to lower productivity and innovation. An effective financial wellness program helps your employees be more confident in their retirement plans, leading to more on-time retirement.

- Turnover: Employees who understand and take advantage of the benefits that your organization offers are less likely to leave for another company for an incremental salary increase. Financial wellness guides your employees to understand better and fully utilize their benefits.

- Absenteeism: Financially knowledgeable employees are less likely to take paid time off due to financial stress.

- Payroll Tax Savings: Financially knowledgeable employees utilize tax-advantaged accounts like HSAs and FSAs to pay for or save for medical expenses. Employers save on payroll taxes from employees who increase their contribution to these accounts.

Employee Value

Financial wellness programs help your employees increase their financial literacy and knowledge, plan for their goals, invest their money, and manage their day-to-day financial lives. It guides employees on their journey to financial success and helps them be more confident about their money.

There is also tangible value for your employees. Our approach to determining the value employees receive from financial wellness takes into account the following factors:

- Healthcare Premium Savings: Employees who receive financial advice are more likely to choose High Deductible Healthcare Plans (HDHP), which cost less in premiums than non-HDHP options.

- Retirement Tax Deferral: Employees who participate in their employer’s retirement plan save through deferring taxes on the income that they contribute.

- HSA or FSA Tax Savings: Financially knowledgeable employees utilize tax-advantaged accounts to pay for or save for medical expenses. Employees save on income taxes and payroll taxes on the money they contribute to their FSA or HSA account.

- Paid Time Off: Financially knowledgeable employees are less likely to need paid time off due to financial stress.

- Retirement: One of the most significant benefits of financial wellness is asset growth over time. Employees who contribute more to their retirement accounts due to financial wellness programs will have money growing and compounding over time, resulting in a large number at retirement.

With the BrightPlan Total Financial Wellness Value Calculator, we’ve taken a conservative approach to determine the ROI of financial wellness. The factors above do not cover all the tangible value of financial wellness. Yet, even with this conservative approach, Total Financial Wellness pays for itself and provides a return on investment.

Ready to see how your company and employees can benefit from financial wellness? Calculate the Total Value and ROI of financial wellness for your company now.