The Coach is an ally in rolling out benefits.

BrightPlan’s Financial Wellness Coach helps HR teams that are stretched too thin.

By answering benefits-related questions, the Coach can become the first point of contact for employees. Instead of spending time responding to emails about 401(k) providers and the like, your HR team can prioritize other tasks.

Your HR team can also trust the Coach to inform employees about important financial planning benefits and how best to use them. So, rather than offer repeated training that cuts into an already jam-packed schedule, HR can refer employees to the Coach for information and insight.

The Coach is a resource you can trust.

The Coach can be a trusted ally when it comes to handling employee questions.

It isn’t an open AI that scours every and any finance website.

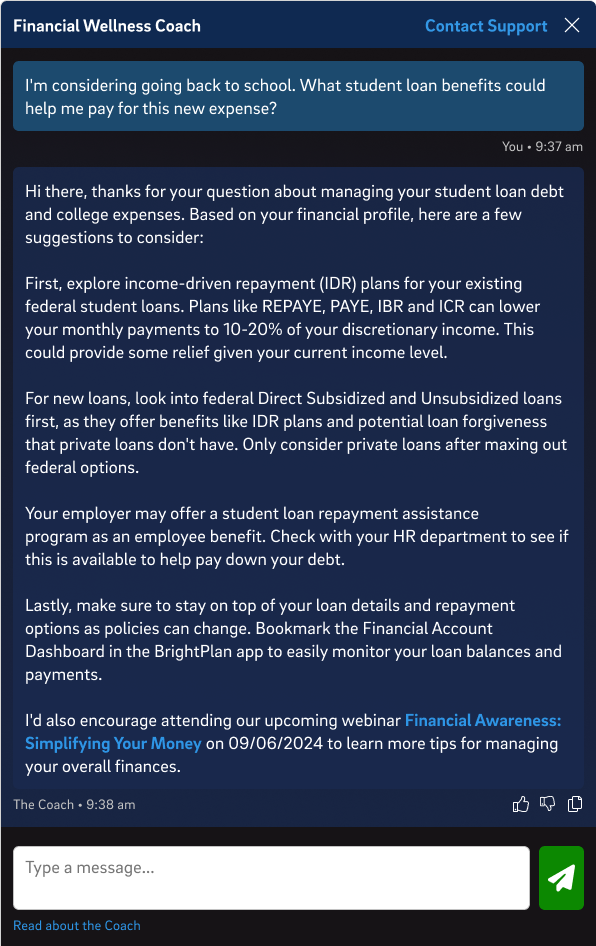

Instead, the Coach is fiduciary and trained on the expert knowledge of certified advisors. When answering employee questions, the Coach will always pull from that regulated database of information and pair it with unique and personal employee insights.

The Coach works for you and only you.

No one wants generic information pulled from random sources on the internet, and they certainly don’t want it when they’re facing an unexpected cost.

Due to its fiduciary nature, the Coach acts in the user’s best interest. The Coach takes all of the information a user provides to develop a clear picture of that person’s financial situation.

The next time an emergency cost arises, your employee will have access to specific advice and actionable next steps.

The Coach is an educational asset and guide

Data shows that employees want to plan ahead.

Even if a person isn’t facing financial hardship presently, there’s comfort in knowing you’ll be taken care of down the road.

The Coach empowers, encourages, and educates so that every user can develop the know-how to navigate a seemingly complicated financial future.

Employees appreciate the opportunity to plan for retirement and general life events. The Coach helps workers make the most out of those opportunities.

Stronger and more personalized benefit answers.

If your employees are fully utilizing their BrightPlan, the Coach can also provide additional clarity on benefit-related questions based on each employee's unique financial situation and goals. This level of personalization for each employee helps them understand how benefits are connected back to their finances and can help them achieve financial success.

Why do other benefit providers love BrightPlan?

As people leaders, you are trying to manage the realities of the business behind the benefits you are offering and the needs of your employees.

As an example, a 401(k) provider is looking to sell retirement investments to your employees. Some providers even offer financial planning resources as part of their offering. However, their goal is to help employees save money for the investments they offer.

BrightPlan only acts in the best interest of your employees (also called our fiduciary duty). We are not selling anything to your employees and the guidance provided is focused only on their financial goals. We work with 401(k) providers who love BrightPlan because we both recognize the need for employees to save for retirement. Having a plan for this important goal means that employees can focus on prioritizing it with their 401(k) provider, based on following their guidance from the Coach.

Tell me more about the Coach

BrightPlan’s patented Financial Wellness Coach provides financial guidance no matter where you live in the world and which language you speak. It is fiduciary in nature and provides real-time financial guidance, available 24/7. It leverages proprietary AI to provide responses. This technology is based on nearly 10 years of regulated and certified content, as well as visibility provided by employees into their financial situations and goals. If there is a preference or need to connect with an in-country advisor based on the question or request, the Coach will help the employee coordinate an appointment.