At a time when employers are challenged with employee engagement, burnout, and retention, companies and HR leaders are doubling down on supporting the well-being of their employees. When asked about the role your organization plays in their lives―especially their financial lives―how many of your employees would be able to say much beyond “My employer gives me a paycheck”?

Instead, what if your employees said, “my company helps me invest in a responsible way that also makes the world a better place.” Or, “my company helps me fund my daughter’s college education.” Or, “my company is helping me retire on time.”

Imagine how much more engaged your employees would be if they felt that your company plays a major role in reaching their life goals. That’s our mission at BrightPlan.

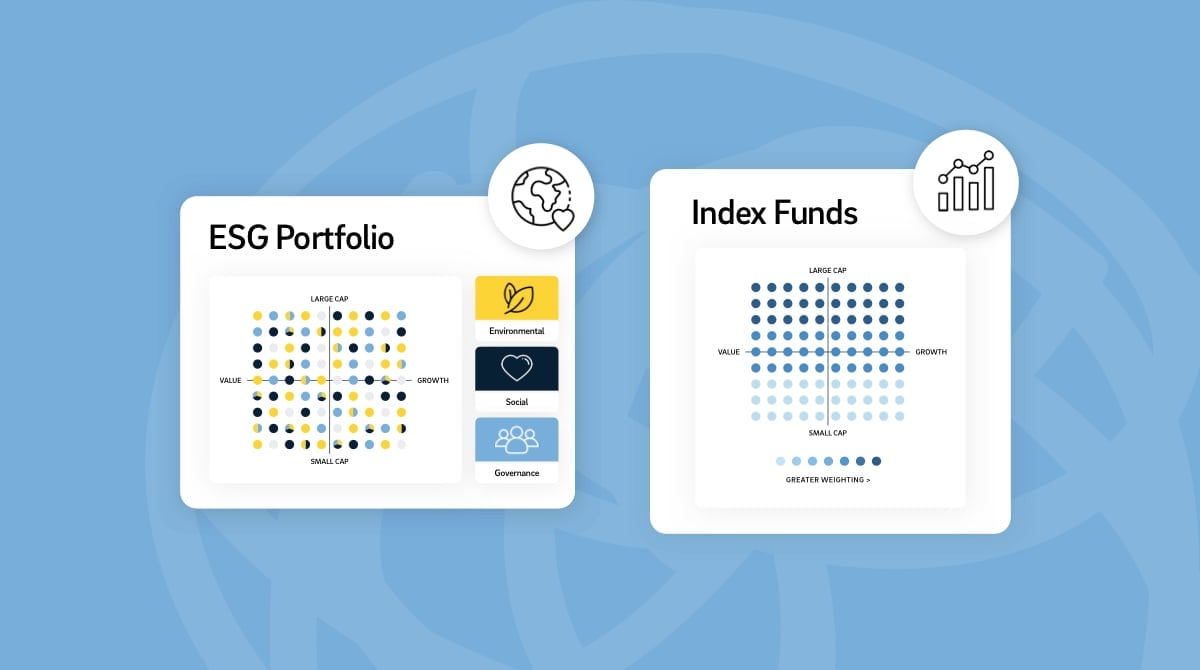

Today, we are excited to announce the launch of BrightPlan’s environmental, social, and governance (ESG) portfolio and enhanced investing capabilities. Investing is one of the most important pillars of financial wellness. It’s a tool to help employees reach their life goals, significantly improving their overall well-being. Achieving long-term goals such as retirement, saving for college, and building wealth is almost impossible without investing.

According to the BrightPlan 2021 Wellness Barometer Survey, 82% of employees want their employer’s help with access to investing tools―making it the top financial wellness feature employees are asking for, along with financial education. Here is what we launched and why:

Environmental, Social, and Governance (ESG) Portfolio

An environmental, social, and governance (ESG) investment portfolio is an approach to investing that considers non-financial aspects of a company’s operations. It enables employees to align their investments with their values by investing in companies that have favorable ESG characteristics and avoiding companies that perform poorly. For example, an employee who cares about climate change may want to invest in companies that have a low carbon footprint or have sizable investments in renewable energy. Likewise, an employee who cares about social issues may want to invest in companies that perform well on gender diversity or have ethical supply chains.

Why is BrightPlan launching an ESG portfolio?

BrightPlan makes it easier for employers to help guide their employees interested in investing aligned with their values without sacrificing market returns1. Most 401(k) plans―often the main investment account employees have―do not offer ESG options. Employers have had limited ways to help employees interested in ESG investing. With this new capability from BrightPlan, employers can more easily offer ESG investing resources to their employees.

There is also some evidence that ESG investments have fewer downside risks than regular investments. ESG investing has increased in popularity in recent years―1 out of every 4 dollars flowing into stocks and bond funds in 2020 went to ESG funds.

How have we crafted the BrightPlan ESG portfolio?

Our ESG portfolios focus on investing in sustainable progress, recognizing that companies solving the world’s biggest challenges may be best positioned for growth. In the stock portion of the portfolio, we use funds managed by BlackRock that give greater weights to companies leading their industry in ESG practices. We also utilize TIAA-CREF to strategically allocate to bonds with direct and measurable impact.

The result is a low-cost, highly diversified portfolio with similar expected risk and return as the overall market. In some cases, ESG criteria can reveal risks and opportunities that aren’t typically captured in traditional financial analysis.

Let’s say you have an employee who cares about climate change. She has $10,000 to invest for long-term wealth building. However, she wants to align her money with her values and either invest it in a single renewable energy company or the BrightPlan ESG portfolio. If she chooses the latter, she’d have her money invested across thousands of companies globally as well as some in government bonds. By spreading out the money, the employee’s investment is much less volatile than if she invested it in a single renewable energy stock. As a result, she’s more likely to meet her goal of building wealth long-term. By constructing the portfolio thoughtfully, BrightPlan handles the heavy lifting needed to invest in ESG responsibly, so your employees don’t have to.

Index Portfolio

What about employees who prefer to keep things simple or employees who find investing intimidating? BrightPlan’s new index portfolio allows employees to invest in the entire stock market. This approach, also known as “passive investing” or “index investing,” is in line with best practices in investment management and is now the default for BrightPlan investment goals.

How have we crafted the BrightPlan index portfolio?

The idea is to invest in a small fraction of nearly every publicly traded company in the globe. We’ve selected index funds from Vanguard because of their long track record and leadership in such funds. As with the ESG portfolio, each index portfolio includes funds. The index funds we’ve picked contain broad exposure to US stocks, international stocks, US bonds, and international bonds2.

Index investing is often referred to as “passive,” because it makes no specific bets on individual companies, countries, or sectors. Each fund simply buys and holds its target index and lets long-term market growth do the rest. This facilitates especially low costs, high tax efficiency, a clear sense of what an employee is invested in, and the ability to widely diversify.

An employee who invests in the index portfolio will spread their money across nearly all publicly traded stocks and investment-grade bonds. As a result, their returns will match the market2. In addition, their mix of stocks and bonds will be personalized for when they need the money, increasing the chances of reaching their financial goal.

Instead of trying to beat the market, an index portfolio aims to be the market. Research shows that low-cost index portfolios also consistently outperform portfolios that pick and choose their investments.

Let’s say you have an employee who just had a baby. He has no time to do anything, much less learn about investing. But he knows that investing is important for his new daughter’s college education. He sets the time horizon (18 years) and monthly contributions and lets BrightPlan do the rest. He will earn returns similar to the market.

Access to investing tools is one of the most powerful resources an employer can provide to help support their employees’ financial and overall well-being. Imagine the look of relief on your employees’ faces when they hear that they will be ok for retirement. Imagine their comfort in knowing they won’t go into debt to fund their child’s college education. What better way to strengthen employee engagement than by helping your employees achieve their life goals?