As data analytics and AI continue to mature, they play a key role in shaping business decisions and improving the health and well-being of our workforce. One powerful data set lies within aggregated and anonymized employee financial data. BrightPlan’s mission is to make financial wellness attainable for everyone. This starts with supporting employees on their financial journey with the right tools and resources. Our digital-led solution guides employees to financial well-being at every stage of life and captures rich data that motivates powerful action in support of employee well-being and business success.

BrightPlan’s Patented Technology Improves Employee Well-being

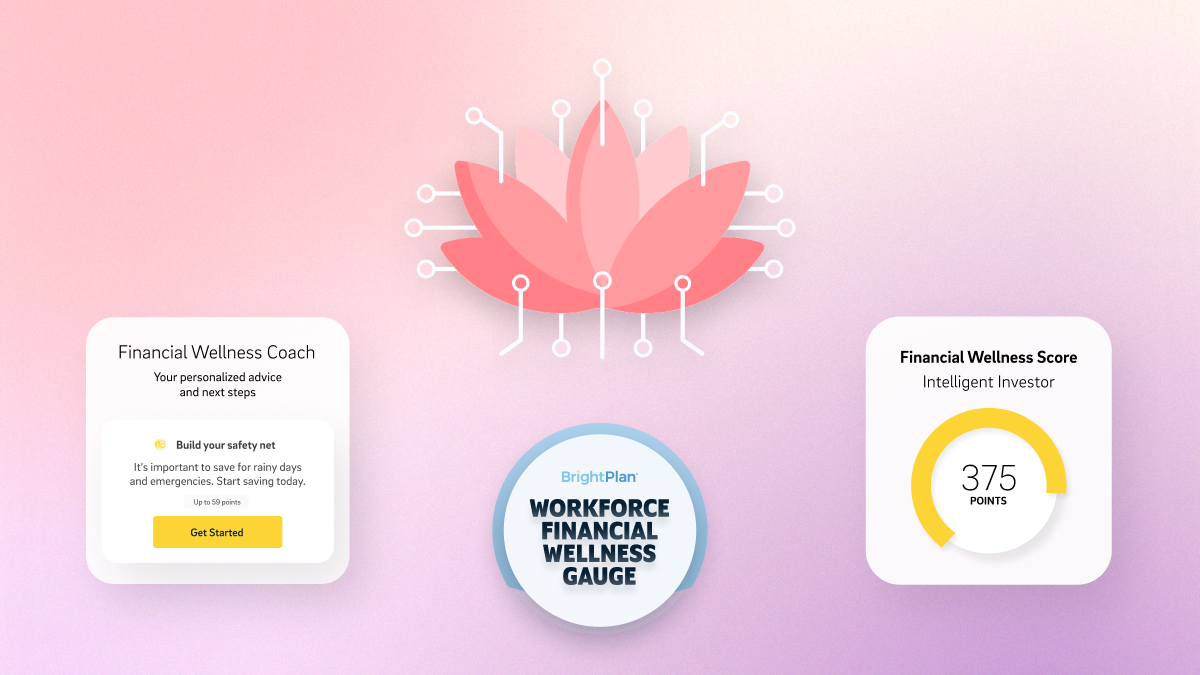

Today we announced BrightPlan’s new Workforce Financial Wellness Gauge (Gauge) to empower employers to more proactively support their employees’ financial well-being. The Gauge is based on aggregated and anonymized data from BrightPlan’s patented Financial Wellness Coach and the corresponding Financial Wellness Score.

Financial Wellness Score

Based on a 500-point system, the Financial Wellness Score continually measures an employee’s progress toward a secure financial plan while reflecting changes in the financial markets. By gamifying the financial wellness process, employees are encouraged to take steps to increase their score and improve their financial well-being.

Financial Wellness Coach

Using an employee’s Financial Wellness Score as a baseline, the AI-powered BrightPlan Financial Wellness Coach dynamically creates a personalized financial plan and provides ongoing guidance and actionable next steps for employees to improve their financial well-being. The Coach advises on every major aspect of personal finance: spending and budgeting, debt management, goals-based planning, investing, retirement planning, estate planning, insurance and financial education. Based on scores in these key areas, the Coach intelligently suggests opportunities for improvement and next steps to take within the BrightPlan digital platform.

Rapid Improvements in Financial Well-being

The real-time analysis of employee financial data along with instant, actionable advice and notifications—delivered 24/7—creates peace of mind for employees and has a consequential impact on their financial well-being. On average, employees who follow the Coach’s advice double their Financial Wellness Score within six months1. This patented technology also enhances the value of 1:1 calls with BrightPlan financial planners. Since financial planners can provide specific guidance based on extensive real-time data, it eliminates the need for redundant questions.

Ultimately, these capabilities empower employees to manage their financial goals and strategically plan for their future while cultivating a strong sense of personal financial well-being. Additionally, monitoring progress enhances motivation to achieve their goals. In fact, employees who use BrightPlan have higher-than-average success in achieving savings-related goals. The median BrightPlan user has a 61% higher retirement savings rate and a two times higher emergency savings rate when compared to the national median.2

Leveraging Data to Improve Employee Well-being

HR teams have a treasure trove of information about their workforce, but they struggle to glean insights from this data that lead to clear action in helping employees reduce financial stress. In order to make informed decisions and better support their people, they need concrete evidence that reveals areas of opportunity. They also need to understand how their efforts are impacting key business metrics, such as turnover, engagement, productivity, benefits utilization, and retirement readiness.

Financial Stress is at an All-Time High

72% of employees are stressed about their finances and 88% expect their employers to offer financial wellness tools and resources to help them. Employee financial stress leads to lost productivity,3 disengagement,4 turnover,4 and delayed retirement,5 which costs U.S. companies over $200 billion per year.

Data is the key to understanding employees’ challenges, but without the right data, employers struggle to serve the varied needs of a diverse and global workforce. So, how can employers effectively embrace financial wellness data to draw meaningful insights that help improve the financial well-being of their workforce and the company’s bottom line?

Workforce Financial Wellness Gauge

BrightPlan’s Workforce Financial Wellness Gauge provides business leaders never-before access to anonymized and aggregated employee financial data, based on real-time employee activity within the BrightPlan platform and segmented by demographics and location. Activity within the BrightPlan digital platform, such as searches within the learning Academy and resource consumption also provide deep insight into employee careabouts.

The Gauge uses three key pillars to track employee financial well-being:

- Financial Commitment: Encompasses metrics like debt load, emergency savings, and self reported credit scores. A low score might indicate employees need help with financial basics.

- Financial Engagement: Looks at data related to BrightPlan log in frequency, educational content consumption trends, and recency of employee conversations with financial planners. A low score might indicate employees could use support taking the right actions to improve financially.

- Financial Empowerment: Measures retirement readiness, progress on education-related savings goals, and more. A low score might indicate employees aren’t planning well for their financial future.

Rapid Improvements in Business Metrics

BrightPlan is the only financial wellness provider with access to extensive data that enables HR and business leaders to identify proactive solutions to boost productivity and improve employee financial wellness. This data is key for driving benefits optimization and ensuring the business is making investments in initiatives backed by tangible workforce needs.

By spotting workforce trends, such as a later than average retirement age or student debt that surpasses the national average for a specific demographic, employers have the knowledge necessary to implement specific and practical solutions that ultimately reduce personal stress and improve employee well-being.

Leveraging data to support your workforce with benefits that matter leads to happier employees and improvements in key business outcomes, including a reduction in turnover costs, a decrease in absenteeism and more productive employees. For example, employee retention is greater among employees who use BrightPlan — for enrolled employees, our customers see a 55% increase in retention over the national average.6

Final Thoughts

The power of data lies within the actionable insights it yields. Amid today’s cost-conscious market environment, real-time data enables employers to make smart decisions that optimize their business. Without meaningful insights, well-intentioned employers are flying blind in their attempts to make measurable progress in driving workforce well-being.

For more information on BrightPlan’s approach to data, read this press release.

Disclosure: We derive our information from a variety of sources we consider reliable, including historical data from fund managers, exchange data, published research, industry digests, and news media, but we do not guarantee that the information is accurate or complete.

Sources:

1. BrightPlan user statistics based on aggregated BrightPlan user data.

2. Savings rate is defined as national median retirement savings and national median emergency savings divided by the national median annual income.

3. Cost of Lost Productivity: BrightPlan 2022 Wellness Barometer Survey

4. Cost of Employee Turnover & Absenteeism: American Society of Pension Professionals & Actuaries. 2018. “Measuring the ROI of Financial Wellness.”

5. Cost of Delayed Retirement: Prudential. 2019. “The Cost of Delayed Retirements.”

6. Based on BrightPlan customer retention data against the national average for retention.